Oracle Corporation, a cornerstone of the IT industry since the 1970s, is a multifaceted company that offers a spectrum of solutions in almost 20 different product categories. With a legacy of innovation and leadership, Oracle has remained a trusted name in the ever-evolving information technology landscape. Let’s explore the diverse world of Oracle.

From One Product to 70+ Solutions

Oracle Corporation was founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates. At first, it was called Software Development Laboratories (SDL), then Ellison, Miner and Oates changed its name to Relational Software in 1979, before adopting Oracle Systems Corporation in 1983. Among its many software, Oracle is recognized mostly for its data management products (due to its flagship Oracle Database) and in business intelligence (thanks to many acquisitions that strengthened the Oracle BI product). Over its long history, Oracle has experienced substantial growth and transformation.

In its early years, Oracle introduced the Oracle Database in 1979, a breakthrough that changed how organizations managed their data. This product set the stage for Oracle’s subsequent development. Throughout the 1980s and 1990s, the company expanded its product portfolio, incorporating enterprise resource planning (ERP) and customer relationship management (CRM) software into its offerings.

Over the years, Oracle has acquired numerous companies to broaden its capabilities and market reach. Notable acquisitions include Sun Microsystems in 2010, strengthening Oracle’s hardware presence. Oracle’s acquisition of PeopleSoft in 2005 and Siebel Systems in 2006 expanded its enterprise software offerings and customer base. In 2012, Oracle bought Taleo, a talent management software, to add more strings to its bow.

In recent years, Oracle has embraced cloud computing and data analytics as key growth areas. It has developed a significant presence in cloud infrastructure services, contributing to its success.

Oracle Corporation’s history reflects a company that has evolved and adapted over the years, becoming a vital player in the technology sector. Its numerous acquisitions and diverse client base underscore its commitment to innovation and expansion in the ever-changing technology landscape.

In EdTech, Oracle Is Involved in Many Product Categories

As mentioned earlier, Oracle is active in many product groups since it has acquired more than 140 companies over the years. Although its revenues coming from education represent a small portion of its total sales, Oracle is one of the biggest solution providers in HigherEd EdTech. This section focuses on this submarket.

When looking at the different product categories where Oracle proposes solutions, business intelligence is undoubtedly the most impressive. On the ListedTech portal, we have data on more than ten solutions from this company, only for this product group. Oracle BI has the most significant market share among Oracle products, with 5%. This could look like a small share, but the BI product category is one of many: we track them in 14 product groups. Among Oracle business intelligence solutions, we notice that some products are being decommissioned to strengthen the main Oracle BI. It’s the case for Hyperion (a solution acquired in 2007). In the Student Information System category, Oracle (11%) is in third place behind Banner Student (25%) and Colleague Student (at 12%).

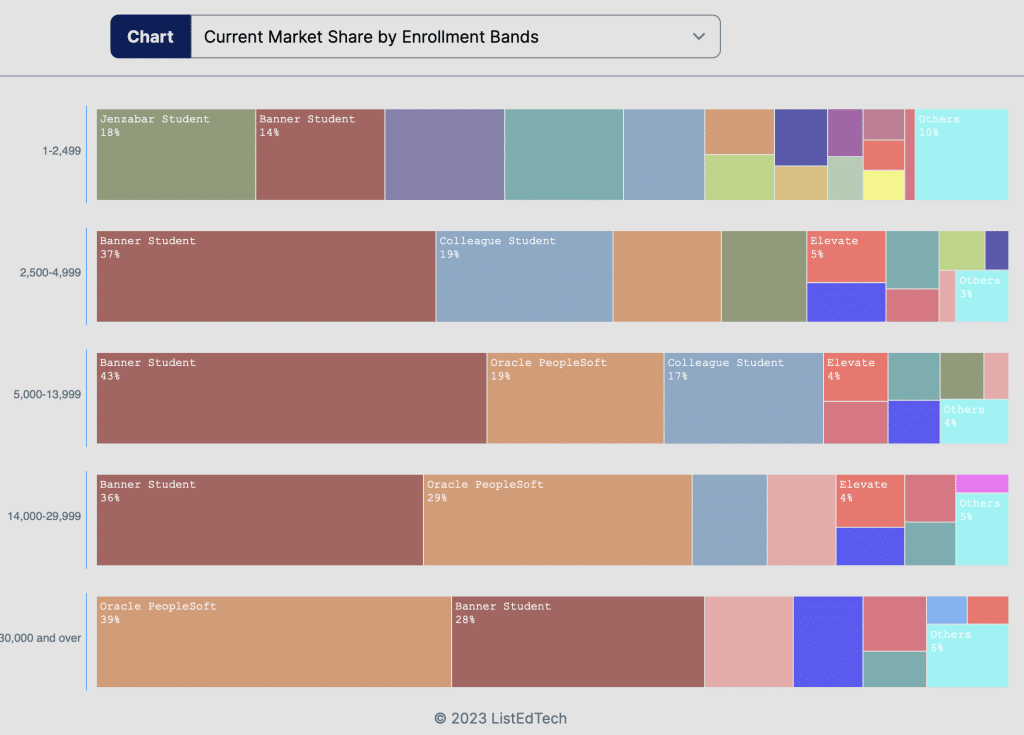

When considering enrollment numbers instead of the number of implementations, Oracle is prominent in the larger enrollment band (leading with 39%), while Banner is more performant in middle-sized universities and colleges.

For the Financial Systems product category, Oracle PeopleSoft Enterprise Financial Management is in fourth position (12% of market share), behind Banner Finance (26%), Colleague Financial Management (14%), and Jenzabar One – Finance (13%). In the Human Resources group, Oracle is tied in second position with Jenzabar One – Human Resources at 14% behind Banner Human Resources at 26% of market share.

A Future Focused on Cloud Solutions

While databases used to be kept on local servers when Oracle Corporation first launched its Database product in the 1970s, the 21st-century strategy is to put everything in the cloud. Oracle is no exception. Moreover, the company’s future involves extensive use of cloud information. Two main business orientations contribute to this cloud-oriented strategy: Oracle Cloud Infrastructure (OCI) and Oracle Cloud Applications (OCA).

Although its competitors also offer cloud servers across the globe, Oracle puts its distributed cloud offer to the forefront: its multicloud approach allows multiple clouds to work as one, citing its collaboration with Microsoft Azure. This new partnership shows that, while Microsoft Azure focuses on the server side of things, Oracle provides the software solution to help customers migrate faster to the cloud. Instead of competing against Microsoft, Oracle has joined forces to help its clients. This is in addition to the 100+ services that Oracle is already proposing.

In addition to the cloud infrastructure, Oracle develops several applications to work in the cloud. As mentioned on its website, Oracle Fusion Cloud Applications help business optimize their workload, make better decisions and get them ready for what’s next. The suite has integrated solutions in the ERP, HCM, Marketing as well as Service.

Aligned together, the cloud infrastructure and applications allow Oracle to propose unified administration and governance, better security, extended application functionality, interoperability, technology updates, and analytics.

What’s Next for Oracle?

At the dawn of its fifty years of existence, Oracle has demonstrated that it is a solid company whose ambition is hampered neither by obstacles nor hazards. However, it could face multiple challenges over the next years:

- Integration of acquired companies: with more than a hundred acquired companies, including more than 40 in the last decade, challenges related to integrating solutions and a constant user experience are possible.

- The cost of its licenses: Oracle often has a higher licensing cost than other solutions on the market. The company may need to reform its subscription plans.

- Customer retention: since it is positioned as a good second in several product categories, Oracle absolutely must retain all of its customers while inviting others to join the group if it wishes to compete more directly with Ellucian, its main competitor ERP.

The challenges are daunting, but with its experience and expertise, Oracle Corporation will certainly be able to succeed.

Product List (from ListEdTech’s database)

Among all product categories, Oracle has the following solutions used in education:

- Business Intelligence: BrioQuery, Hyperion, Oracle Business Intelligence, Oracle Business Intelligence Suite.

- CRM – Admissions: Oracle PeopleSoft Enterprise Recruiting and Admissions.

- CRM – Alumni: Oracle PeopleSoft Enterprise Contributor Relations.

- CRM – General: Oracle CRM, Oracle PeopleSoft Customer Relationship Management (CRM).

- Financial Aid: Oracle PeopleSoft Enterprise Financial Aid.

- Financial Systems: Oracle Cloud Financials, Oracle E-Business Suite Financials, Oracle Financials, Oracle PeopleSoft Enterprise Financial Management.

- Grants – Financial ERP: Oracle PeopleSoft Enterprise Grants Management.

- Help Desk: RightNow CX.

- Human Resources: Oracle E-Business Suite HRMS, Oracle Human Capital Management System, Oracle PeopleSoft Enterprise Human Capital Management.

- Labor Management: Taleo Talent Intelligence.

- Planning, budgeting and forecasting: Oracle Hyperion Planning.

- Portals: Oracle PeopleSoft Enterprise Campus Self-Service, Oracle PeopleSoft Enterprise Portal.

- Portfolio and Project Management: Primavera.

- Student Information Systems: Oracle PeopleSoft Enterprise Campus Solutions, Oracle Student Cloud.