Key Takeaways:

- System Dominance: In almost all mergers, the larger institution’s systems are retained due to scalability, integration, and support advantages.

- Pre-Merger Alignment: Shared systems before a merger, often coincidental, significantly simplify post-merger integration.

- Modernization Opportunity: Mergers create rare opportunities to update IT infrastructure, retire legacy systems, and renegotiate vendor contracts.

Institutional mergers are often presented as opportunities for growth — stronger financial stability, expanded academic offerings, and a broader institutional footprint. However, beyond the public announcements, one of the most significant challenges lies in the integration of technology systems. Decisions about which platforms to retain have long-term implications for efficiency, user experience, and operational costs.

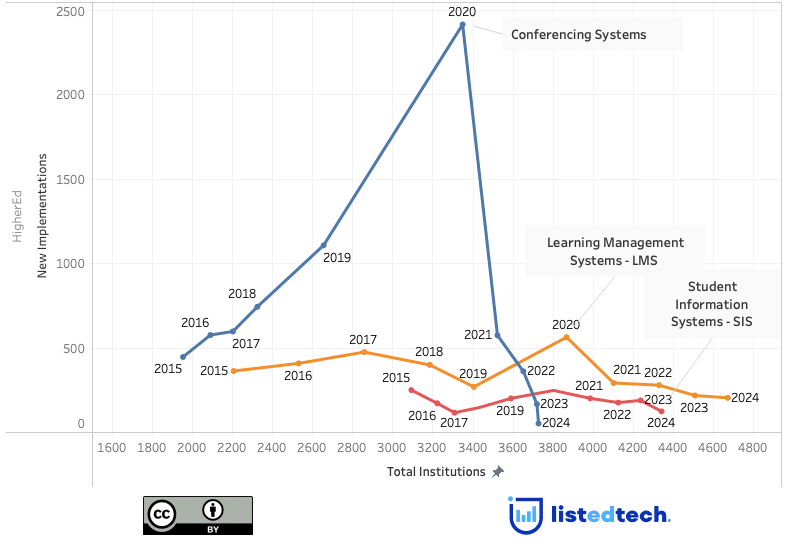

Recently, inspired by two articles on IT consolidation “When Universities Merge, Legacy ERP Systems Don’t: The Higher Education Consolidation Conundrum: and Integrating IT Operations When Colleges Merge: (from ERP Today and EdTech Magazine), we decided to dig deeper. Drawing on ListEdTech’s database of thousands of institutions, this post examines system decisions during mergers and highlights trends that emerge from the data.

Key Observations from the Data

The Larger Institution’s Systems Usually Prevail

This trend appears consistently in ListEdTech’s database: in most mergers, the systems used by the larger institution become the unified platforms post-merger. For example, when a smaller liberal arts college using Populi (LMS and SIS) merges with a mid-sized regional university operating on Moodle and Workday, the latter’s systems are typically adopted. This choice reflects factors such as scalability, existing integrations with finance, HR, and CRM systems, and well-established user support.

Pre-Merger System Alignment Is Not Uncommon

As EdTech Magazine notes, some mergers are facilitated by pre-existing technology alignment. In several cases, institutions already share the same LMS or SIS before merger talks begin. Whether by coincidence or as a strategic precursor to consolidation, this alignment greatly simplifies the post-merger integration process.

Legacy Systems are Rarely Retained

Even when smaller institutions have recently invested in a new SIS or LMS, these platforms are often replaced post-merger. Consolidation reduces complexity, supports compatibility, and minimizes administrative overhead.

Why Larger Systems Are Retained

According to analysis in ERP Today, decisions are typically driven by operational scale rather than product quality. Larger institutions often benefit from:

- Established training for end users

- Mature integration across finance, HR, and CRM systems

- Larger IT teams with relevant expertise

- Long-term vendor contracts and negotiated pricing

Switching to the smaller institution’s platform would typically require extensive retraining, renegotiation, and reintegration — costs that outweigh the potential benefits.

Mergers as a Catalyst for System Modernization

Mergers present a rare opportunity to address long-standing technology challenges. As ERP Today observes, universities often retain aging ERP platforms and SISs well past their prime because the disruption of change is perceived as too great. A merger creates conditions in which change becomes both necessary and feasible.

During this period, institutions can consolidate overlapping systems, transition from on‑premises deployments to cloud-based solutions, adopt modular or composable ERPs and SISs, and establish unified infrastructure that supports long-term growth. These changes are generally easier to implement when contracts, workflows, and governance structures are already under review.

Contractual Considerations

Long-term vendor contracts can complicate post-merger technology integration. Institutions may temporarily maintain multiple systems, pay early termination fees to accelerate unification, or leverage the merger to renegotiate contracts for better pricing and service packages. As EdTech Magazine highlights, these negotiations often open opportunities to simplify the technology landscape and reduce long-term costs.

Table 1. Recent Higher Education Mergers & Acquisitions

| Institution(s) Combined | Type | Year / Status | Notes |

|---|---|---|---|

| Vermont State University (Castleton, NVU, Vermont Tech) | Public | 2023 (completed) | 3 public colleges merged into one; shared accreditation |

| Commonwealth University of Pennsylvania(Bloomsburg, Lock Haven, Mansfield) | Public | 2022 (completed) | Part of PASSHE restructuring |

| Connecticut State Community College (12 CCs) | Public | 2023 (completed) | Created one statewide college |

| University of Texas at San Antonio + UT Health San Antonio | Public | 2025 (in progress) | Health + academic merger; large combined budget and endowment |

| Saint Joseph’s University + University of the Sciences (USciences) | Private | 2022–2024 (completed) | Systems like Workday, Google Workspace unified post-merger |

| Saint Joseph’s University + Pennsylvania College of Health Sciences | Private | 2024 (in progress) | Second recent merger for Saint Joseph’s |

| Albany College of Pharmacy + Russell Sage College | Private | 2025 (pending) | Will combine health + liberal arts |

| University of Findlay + Bluffton University | Private | 2024–25 (pending) | Small regional merger; facilitated by HCS |

| Bay Path University + Cambridge College | Private | 2024 (completed) | Acquisition of career-focused programs |

| St. Ambrose University + Mount Mercy University | Private | 2024 (announced) | Will operate under St. Ambrose brand |

| Northeastern University + Marymount Manhattan College (MMC) | Private | 2024 (pending) | Adds to Northeastern’s global campus system |

| Seattle University + Cornish College of the Arts | Private | 2025 (in progress) | Arts/business synergies |

| Drexel University + Salus University | Private | 2023 (completed) | Absorption of health sciences school |

| Calvin University + Compass College of Film & Media | Private | 2023 (completed) | Compass fully integrated into Calvin |

| Lewis University + St. Augustine College | Private | 2023 (completed) | Enhances capacity and continuity |

| Notre Dame of Maryland + Maryland University of Integrative Health | Private | 2023–24 (in progress) | Multi-year transition underway |

| East Texas Baptist University + Carroll Theological Institute | Private | 2023 (announced) | Carroll becomes ETBU Seminary |

| UHI North, West and Hebrides (Scotland) | Public (UK) | 2023 (completed) | 3 UHI-affiliated colleges merged |

Questions for Future Analysis

We plan to continue working with this data to explore the following questions in greater depth:

- Pre-Merger Alignment: How often do merging institutions already share key systems, and is this part of early strategic planning?

- Contract Timing: How do contract expiration dates influence technology decisions, and could synchronized renewals make mergers more attractive?

- Organizational Integration: How quickly do IT teams merge compared to their systems, and what models of governance support successful integration?

Conclusion

Technology system decisions are rarely part of the public narrative during higher education mergers, yet they directly influence the student experience, operational efficiency, and long-term institutional success.

For institutions planning or observing a merger, the key questions remain:

- Which systems will be retained?

- What costs are associated with the transition?

- How will these decisions support the institution’s strategic objectives?