Key Takeaways:

- Peer Networking: Most professionals still rely on word-of-mouth, LinkedIn groups, and associations to learn about tech adoption.

- Fragmented Process: Informal methods are time-consuming, incomplete, and often biased, leaving leaders without a full picture.

- Data at Scale: With its database, ListEdTech turns scattered anecdotes into structured, comprehensive insights that save time and guide better decisions.

In the last few months, I’ve been asking my LinkedIn connections, the following question:

“How do you learn what technology your peers at other institutions are using?”

Over the last few months, nearly 400 professionals answered this question. Their responses highlight both the creativity and the challenges institutions face when trying to keep up with the fast-changing world of educational technology.

What We Heard From Institutions

How Institutions Learn About Peer Technology Choices

From our analysis of 370+ answers, here’s how HigherEd professionals say they find out what their peers are using — along with sample quotes to bring the data to life:

Peer Networking & Word of Mouth (64 mentions)

Many rely on direct conversations, whether at meetings, webinars, or informal chats with colleagues.

“Mostly through conversations with colleagues I’ve known for years.”

“Word of mouth is still the best way.”

LinkedIn & Online Communities (57 mentions)

Social platforms like LinkedIn and professional discussion forums play a big role.

“Discussions in LinkedIn groups are surprisingly useful.”

“I rely on online forums and community Slack channels.”

Associations & Professional Organizations (45 mentions)

Groups like EDUCAUSE, AACRAO, and regional associations remain trusted sources.

“AACRAO publishes great insights.”

“Our state association shares regular technology updates.”

Independent Research (42 mentions)

Leaders frequently search online, benchmark against peers, and analyze data themselves.

“A lot of my time is spent just Googling and comparing.”

Conferences & Events (27 mentions)

Annual conferences are still critical hubs for discovery and sharing.

“I usually find out at EDUCAUSE or our regional user group meetings.”

“Conferences are where I hear the most about what other schools are adopting.”

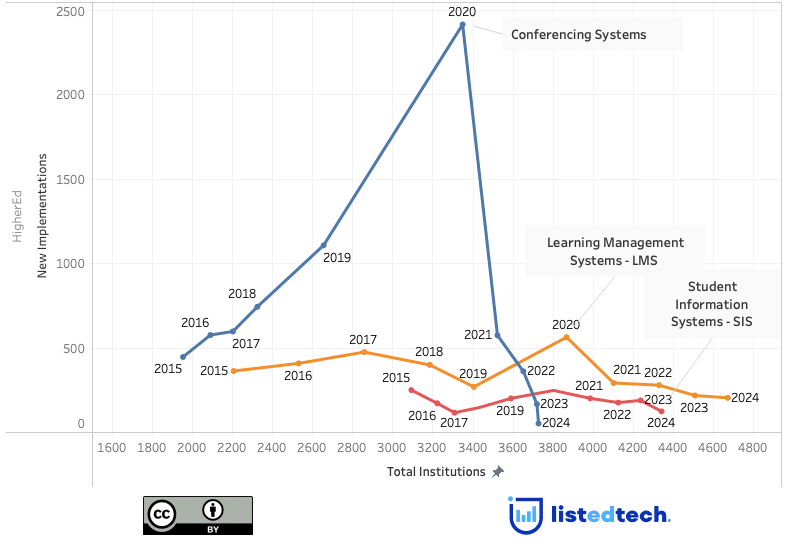

Reports & Databases (25 mentions)

Some mentioned industry surveys or databases (like Gartner, HolonIQ, or ListEdTech).

“Industry reports give me a quick snapshot.”

“I use ListEdTech to check which systems are being adopted.”

Vendors & Consultants (18 mentions)

Many hear directly from vendor representatives or consulting partners.

“We ask vendors what they see other clients doing.”

“Consultants often bring in peer examples.”

Procurement & RFPs (3 mentions)

A smaller group referenced formal procurement processes.

“We learn the most during RFPs when we see what others specified.”

👉 Interestingly, the largest bucket — 162 responses — fell into “other or unclear,” a reminder of how fragmented and ad-hoc this process can be.

The Challenge: Peer Technology Discovery Is Fragmented

The answers reveal a clear pattern: most professionals rely on scattered, informal methods — hallway conversations, social media, occasional conferences. While valuable, these methods are:

- Time-consuming: you need to know the right people and be in the right rooms.

- Incomplete: you hear about a few technologies, not the full market.

- Biased: hearing about tools peers like, not necessarily what’s widely adopted.

This explains why institutions often struggle to get a clear, data-driven picture of the EdTech landscape.

How ListEdTech Scales This Work

What we did manually with 400 responses is exactly what ListEdTech does at scale:

- Continuous data collection: Instead of a few hundred answers, we track thousands of signals every day across institutions worldwide.

- Structuring unstructured input: Just as we categorized answers into themes, we transform raw information into clean, structured datasets.

- Comprehensive coverage: Our database spans higher education and K–12, with detailed adoption data on dozens of technology categories.

- Accessible insights: Instead of piecing together anecdotes, our subscribers get a searchable, reliable portal that makes comparisons easy.

In short: we take the word-of-mouth process institutions already use — and scale it up into a data resource that saves time and drives better decisions.

Why This Matters

Technology choices shape the student experience, faculty productivity, and institutional competitiveness. Yet, too often, leaders rely on fragmented information. Our goal at ListEdTech is simple: to make peer technology adoption transparent, structured, and actionable.