This post originates from a discussion with a client. He was wondering if an institution tends to select additional products from the same product suite if it were to expand its IT offering. From the data collected at ListEdTech, the answer is that it depends on the product category.

For some product groups, we note that if an institution has already implemented one product from a product suite, it would be more inclined to select other products from this suite.

Why?

- The product will integrate seamlessly with the other products in place.

- Usually, this business practice requires fewer resources.

- The institution only deals with one company for several transactions (possibility of a discount on multiple contracts?).

If an institution selects the best-of-breed product, this could lead to more complex integration. However, the institution would install a product that answers nearly all its needs and concerns.

Two Product Categories: Two Stories

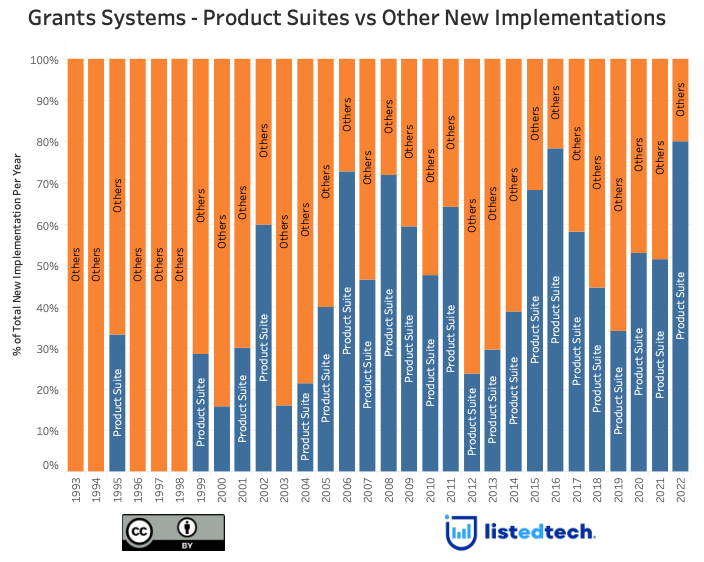

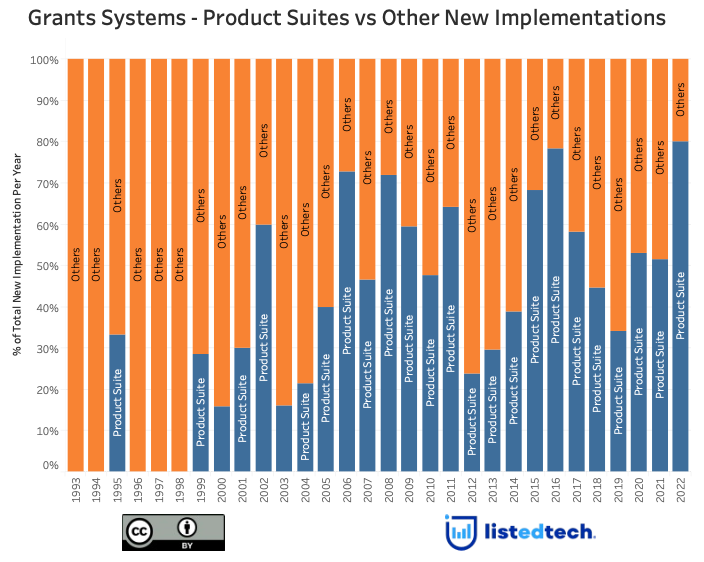

To explore the best-of-suite approach, we have selected two product categories: Grants and CRM. For the grant group, we have chosen companies with extensive product offerings: Cayuse, Huron and InfoEd.

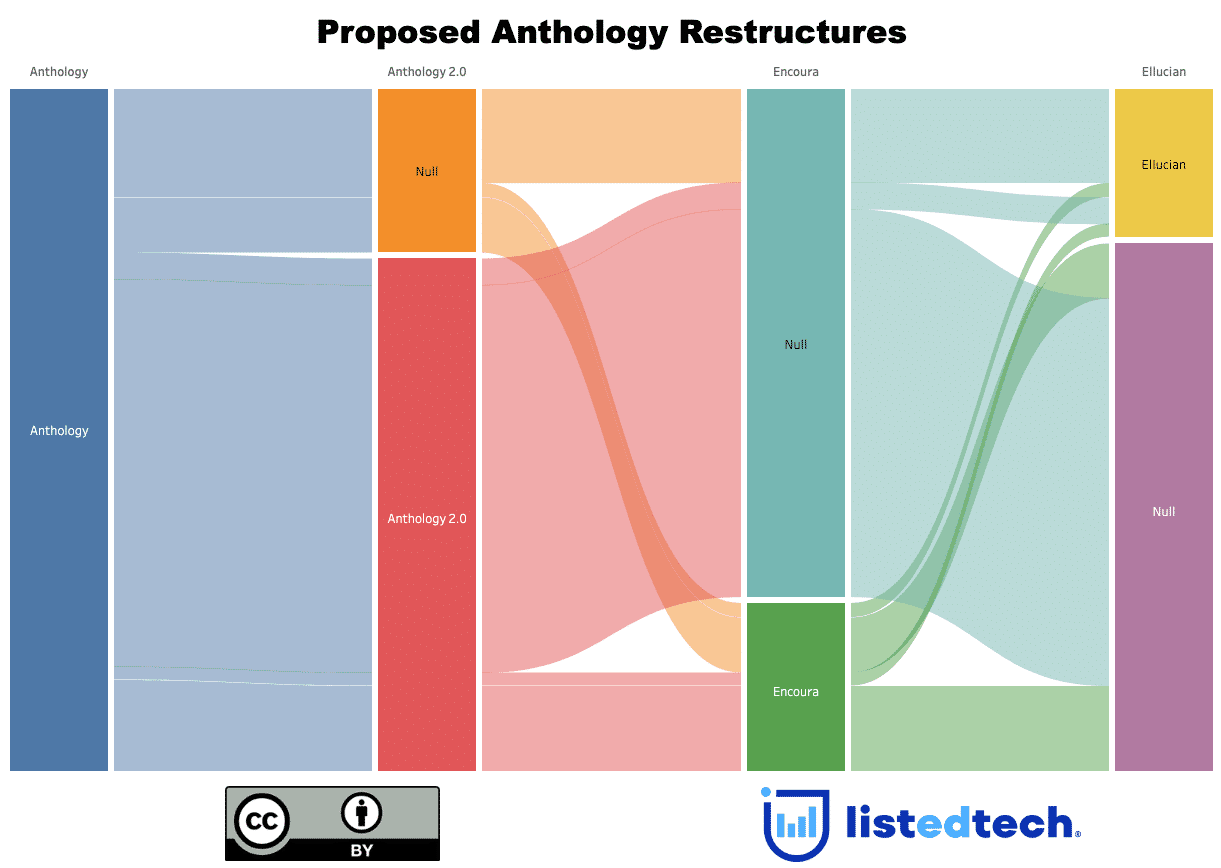

With companies developing their product offering over time, institutions implement more products as part of a product suite every year. Recently, multiple acquisitions we saw in the grant product category also reinforce this best-of-suite approach.

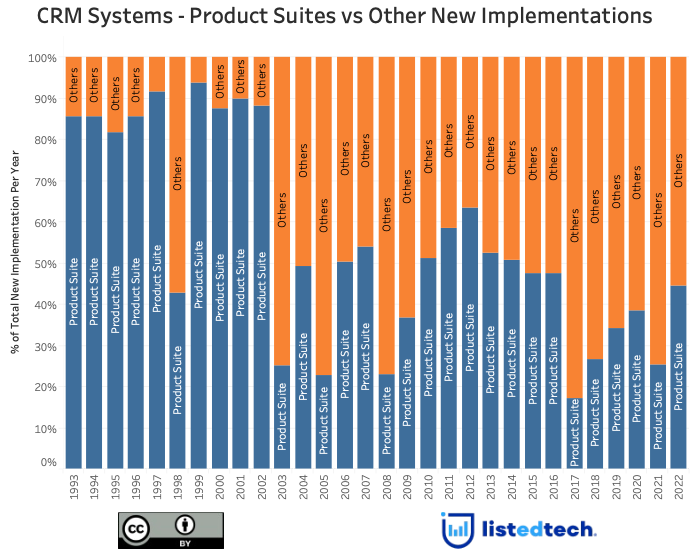

The trend in the Grants product category is not one we see across all product groups. We notice the opposite situation in the CRM broader product category (Admissions, Alumni and General). The “stand-alone” implementation is more common nowadays than in the product suite.

In the CRM product group, it is not rare to see multiple product implementations for one institution. ERP solutions usually include a CRM/Communication tool that is often not tailored to the institution’s situation. Therefore, the university/college chooses to implement another CRM software. It is usually a niche product to address specific tasks: admission process, donor relations, or specific faculty/office requirements. This second or third CRM implementation might be out of the product suite.

Note: For the CRM product group, product suites include all ERP and large CRM companies with multiple (5+) products.

Institution employees and higher management: does your institution have more of a best-of-suite or a best-of-breed approach? We would love to hear your stories. Share them on our social media: LinkedIn, and Twitter.