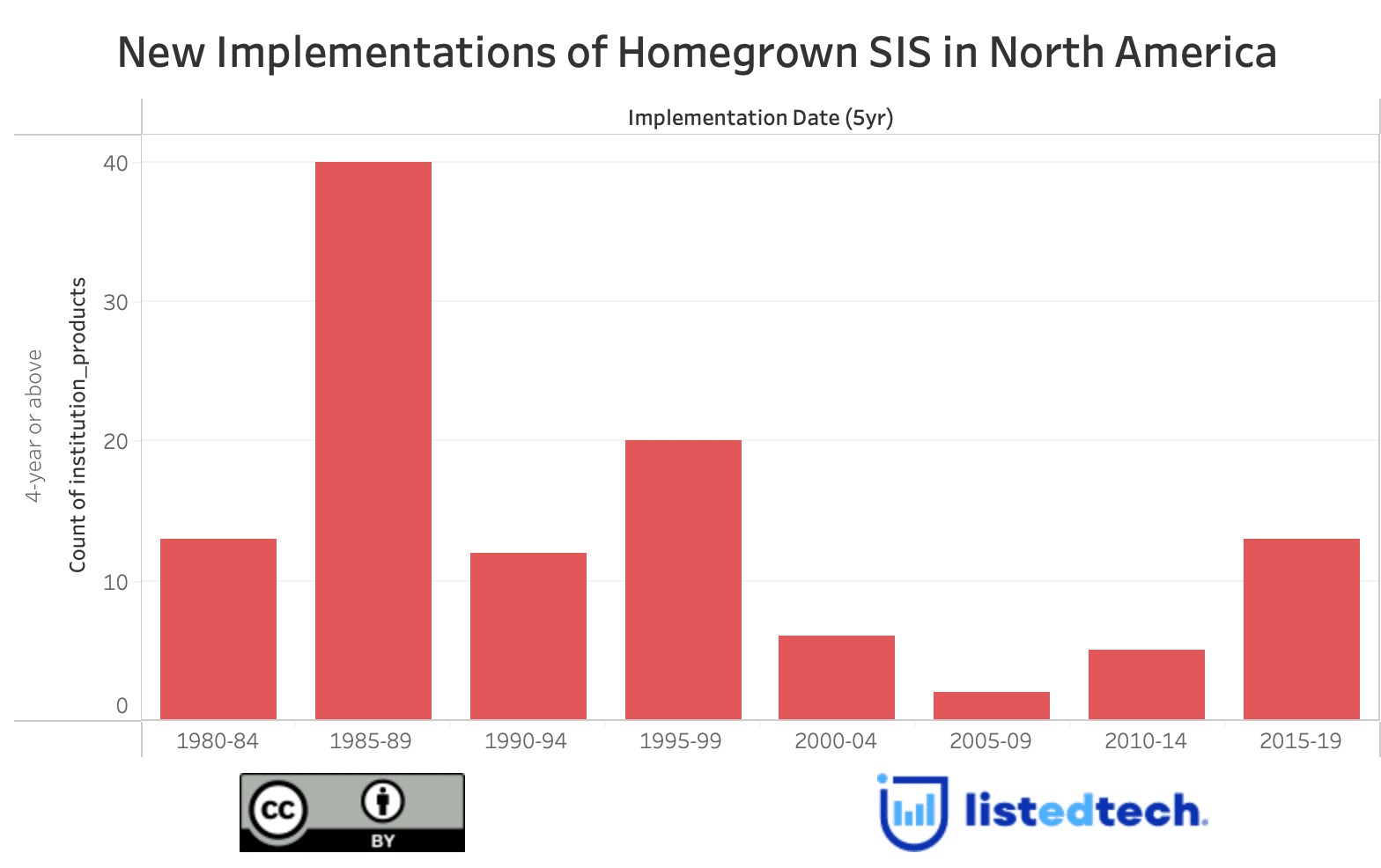

In the past year, we noticed something we had not imagined possible: homegrown student information systems are coming back. The question on everyone’s lips: why is that?

Historical Market Share

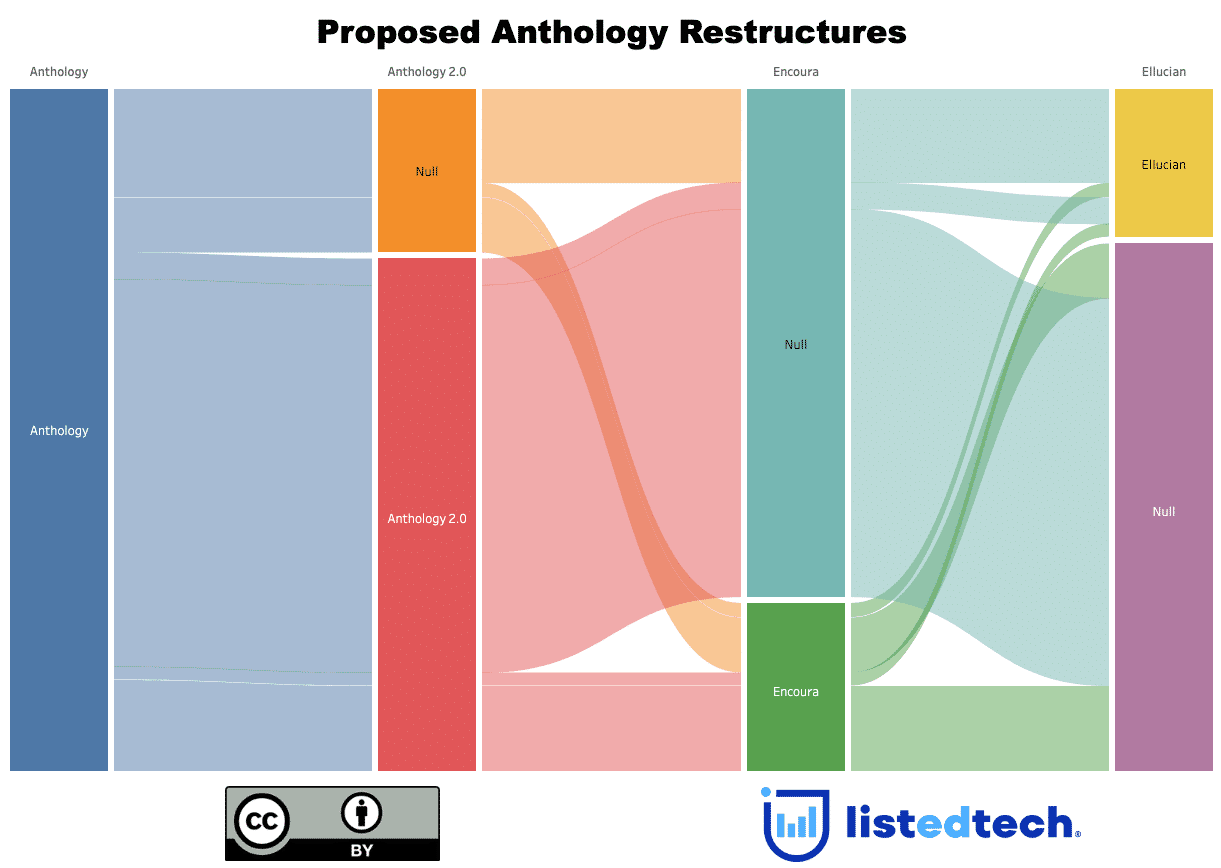

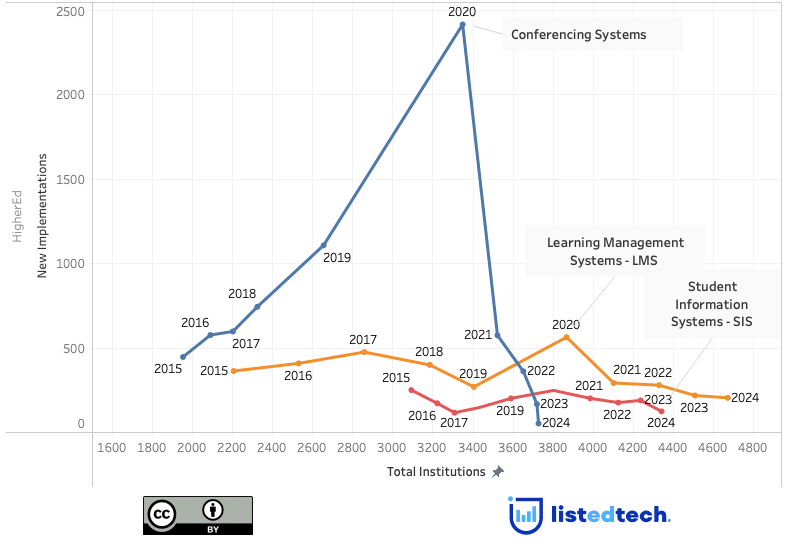

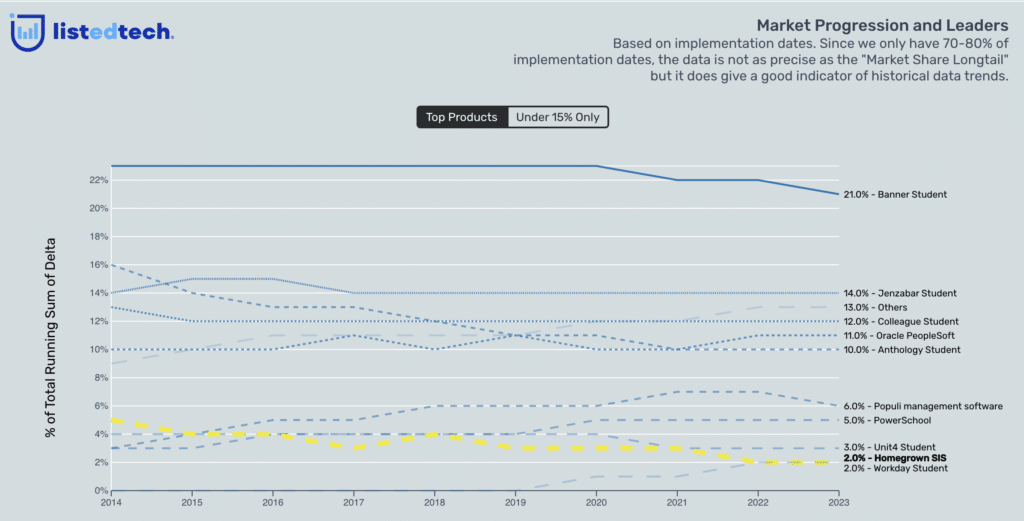

The market share of homegrown systems has decreased over the years. From about 5% in 2014 to 2% in 2022. It has been a slow decline. Using our data, we know that the current active systems have, on average, 22 years, making them the longest average age in the whole student information systems category. When an institution changes its homegrown solution, it usually selects Oracle’s Peoplesoft (about 50% of the time) or Workday Student (about 25%).

Why Are Homegrown Systems Popular?

Everyone who has had the pleasure of doing a gap analysis knows there is no perfect system. The product selection committee tries to select the software that can fulfill its wish list. Then, the most important of all arises: can we afford it? After months, if not years, of preparation work and selection process, the institution implements the system, using different configurations, to satisfy the mentioned needs.

Many decisions have to be discussed and ultimately made during the replacement project. Let’s take the example of tuition fees:

- Does the institution charge student fees by hour or by credit?

- Is there a flat fee for all, or does it charge a minimal fee?

- Does the annual increase apply to all programs or only undergraduate? What about STEM versus Arts students?

- Does the institution charge more to international students than domestic ones?

- Is it the same increase rate across the board?

By listing these questions, it is clear that each institution has its own vision of how tuition fees should be calculated.

For this type of reason, system providers pack their modern SIS with several “and,” “if,” and “or” in the code to accommodate the most common scenarios. The institution begins the replacement process intending to use the vanilla version of the product. Universities and colleges often use the vanilla-flavoured SIS at 90%, but they will still add a few customizations.

A new product update is usually available as soon as they are done with the product implementation. This new version offers some great new features and some that the institutions will never use. If they choose to install the update, they must consider the impact on their customizations: will they all work with the new version? As previously mentioned, a commercial product will have many options coded in its core to accommodate different administrative structures and decisions. Homegrown systems only have what the institution needs, nothing more. It also explains why institutions have kept these solutions implemented for many decades: they answer the institution’s needs and are code stable.

Homegrown > Commercial?

Like most software development, the dominating standard is to build software that several companies/institutions can implement. This model works for most systems, but the SIS is the most complex system used by an institution. Not only is it connected to other systems used by the university, but it also is central to the institution’s identity.

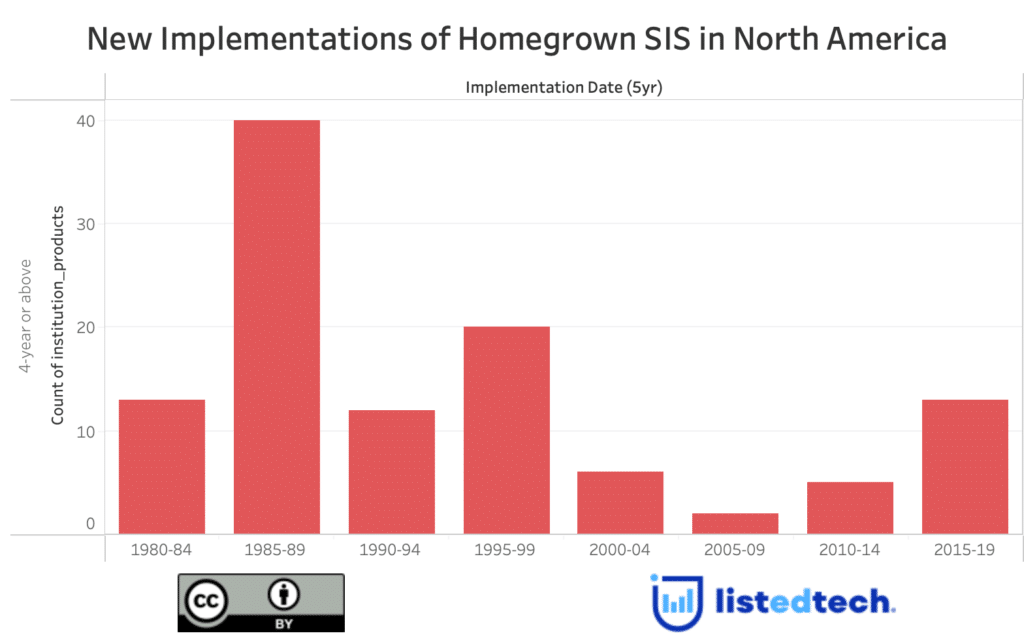

In the 80s and 90s, several institutions built their own SIS since the available products were often new to the market and did not have the maturity needed. Since then, some institutions have had to replace their homegrown SIS because the code used to program the software (Cobalt, Natural) was no longer supported. The main business of an institution is education and research, not the development of complex software, which is another reason to select a commercial solution.

The main difference between current commercial solutions and homegrown systems: the latter answers all of the institution’s needs. With many unsuccessful tentatives of commercial SIS implementation in the past years, institutions might want to return to the stability of what they once knew.