Key Takeaways:

- The HigherEd HR System Market is Shifting Toward Cloud-Based Solutions

Institutions are moving away from legacy on-premise HR systems in favour of more flexible and scalable cloud-based platforms, with Workday emerging as the fastest-growing vendor.- Different HR Systems Serve Varying Institutional Needs

Small institutions typically use HRIS for core administrative tasks, mid-sized universities opt for HRMS with talent management features, and large research universities require HCM platforms with workforce planning and analytics.- Workday is Gaining Market Share While Legacy Systems Decline

Workday HRM has experienced significant growth, surpassing several legacy solutions like Jenzabar One, Banner HR, and Oracle PeopleSoft, particularly among large universities. If current trends continue, Workday could become one of the top two HR systems in higher education.

Managing people effectively is at the heart of every higher education institution—whether it’s hiring top faculty, tracking payroll, or ensuring compliance with evolving regulations. But as colleges and universities grow in size and complexity, so do their HR needs. We observe the following trends in the HigherEd HR market:

- Small institutions often rely on streamlined HRIS (Human Resource Information Systems) to handle core administrative functions like payroll and employee records.

- Mid-sized universities may need more advanced HRMS (Human Resource Management Systems) that integrate talent management, recruitment, and performance tracking.

- Large research universities require comprehensive HCM (Human Capital Management) platforms that incorporate workforce planning, employee engagement, and data-driven analytics.

With shifting demands, the HigherEd HR system market is evolving, moving away from legacy on-premise solutions toward cloud-based platforms that promise flexibility and scalability. This shift is reshaping vendor dominance, with players like Workday rapidly gaining ground.

At ListEdTech, we track technology trends (including HR) in education across the globe to help institutions make informed, data-driven decisions. Here’s a look at the current HR system landscape, the major players, and the market trends shaping the future.

HRMS, HRIS, or HCM? What’s the Difference?

The world of HR technology is filled with overlapping acronyms, making it difficult for institutions to determine which system best fits their needs. In a previous post, we covered the several functions of HR systems. Here are the key distinctions between the three major system types:

- HRIS (Human Resource Information System) – Focuses on core administrative tasks like employee records, payroll, and benefits.

- HRMS (Human Resource Management System) – Expands on HRIS capabilities by adding talent management, recruitment, and performance tracking.

- HCM (Human Capital Management) – Encompasses HRIS and HRMS functions but also integrates workforce planning, employee engagement, and analytics.

Most colleges and universities use a mix of these systems, with some vendors specializing in one area while others offer all-in-one solutions.

Who’s Leading the HigherEd HR Market?

Several vendors dominate the HR system landscape in North American HigherEd. Based on our data, the top systems in use are:

- Banner HR and Colleague HR (both proposed by Ellucian)

- Jenzabar One HR

- Workday Human Resource Management

- Oracle PeopleSoft Enterprise HCM

- Others, including Unit4 HCM, Microsoft Dynamics, and PowerCAMPUS HR

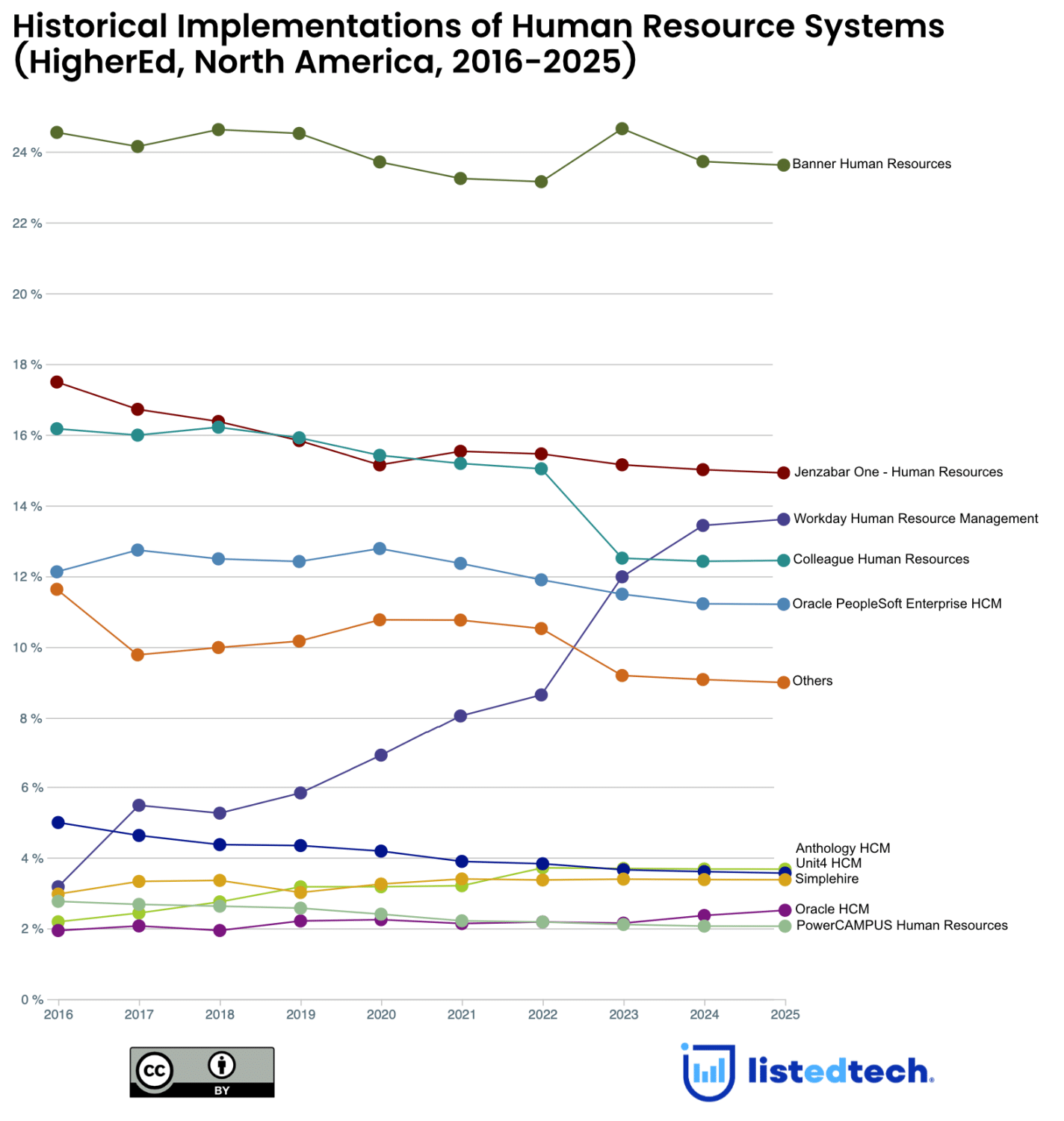

The historical market share graph provides key insights into the shifting landscape of HR systems in North American higher education. Here are the notable trends:

- Banner Human Resources is holding its ground but facing slight declines.

- Banner remains the most widely used HR system (at around 24%), consistently maintaining the highest market share.

- However, its growth has plateaued, and signs of a slow decline suggest that institutions are exploring alternatives.

- Workday is the fastest-growing HR system in higher education.

- The graph shows Workday HRM rising steadily, surpassing several legacy systems between 2022 and 2025. During this period, Workday became the third most implemented HR solution, coming from the sixth place.

- This aligns with the industry-wide shift toward cloud-based solutions and modern HR platforms.

- Jenzabar One and Oracle PeopleSoft are slowly losing ground.

- Colleague HR has maintained a relatively stable presence.

- As Workday continues to gain market share, Colleague HR appears to be losing ground at a similar rate, creating a mirror-effect trend.

- Smaller players like Unit4 HCM and Anthology HCM remain niche.

- These systems occupy the lower range of market share, indicating that they serve specific institutional needs but have yet to gain widespread adoption.

Overall, the data reinforces that cloud-based HR systems are the future of higher education, with Workday leading the transition.

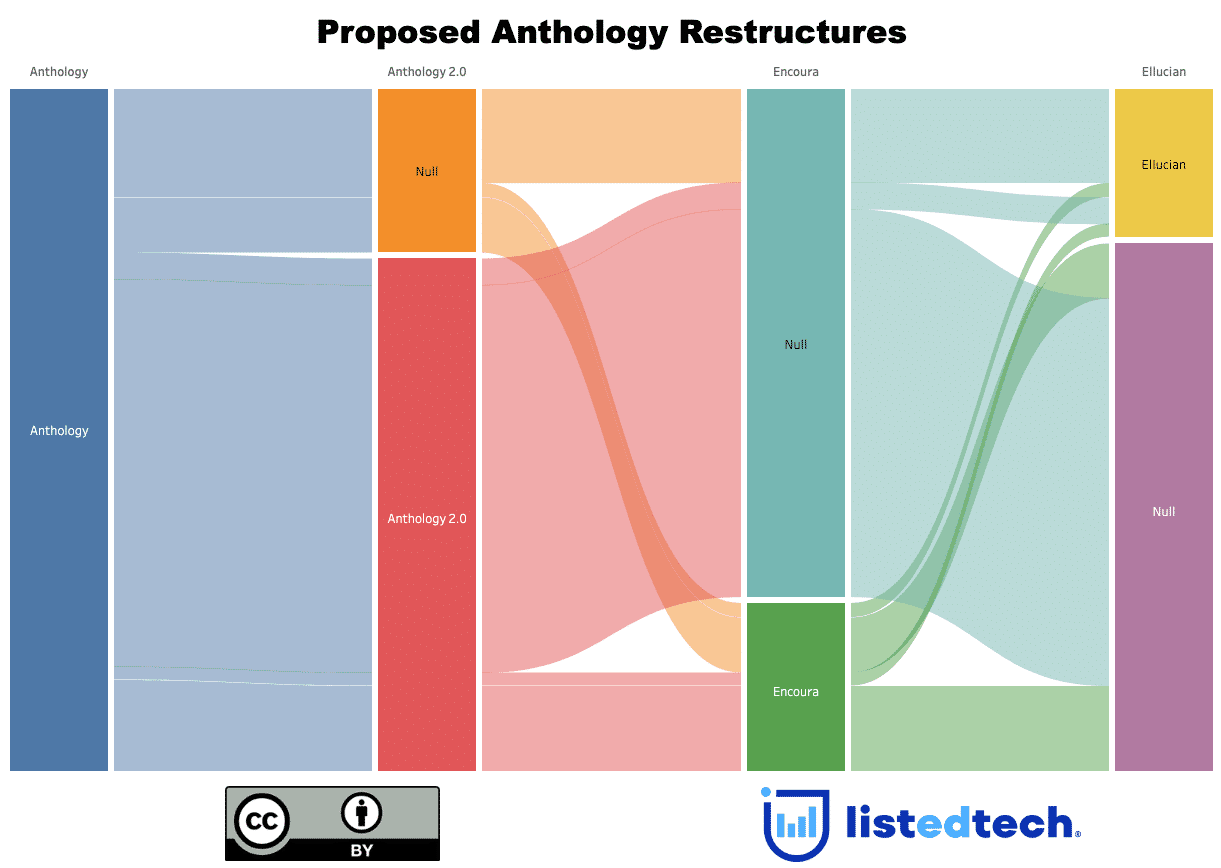

What’s Driving Workday’s Expansion?

Now powering 11.4% of active HR implementations (or 4.2 million students as of 2025), Workday’s rapid growth in higher education can be attributed to several key factors. The ongoing shift to cloud-based solutions has led many institutions to move away from on-premise systems, positioning Workday as a leading alternative. Over the last decade, Workday has frequently replaced Jenzabar One – Human Resource, Homegrown HR systems, Banner Human Resources, Oracle PeopleSoft Enterprise HCM, and Colleague Human Resources

This trend is particularly evident among large universities, where Workday has achieved the highest penetration, currently reaching 15% of institutions with 30,000+ students—a figure that is expected to rise. At the same time, legacy systems such as Oracle PeopleSoft Enterprise HCM are steadily losing market share, creating further opportunities for modern platforms. If Workday continues to replace these older systems at its current pace, it could potentially secure a position as one of the top two HR systems in higher education.

Final Thoughts on HigherEd HR Market

The HR technology landscape in higher education is undergoing a major transformation. With cloud-based solutions gaining ground and legacy systems fading, institutions need to carefully assess whether they require an HRIS, HRMS, or HCM to align with their long-term strategy.

At ListEdTech, we continue to monitor these shifts, providing valuable insights into the evolving higher ed IT ecosystem. For deeper data on HR technology trends and higher ed IT systems, explore the ListEdTech portal.