Key Takeaways:

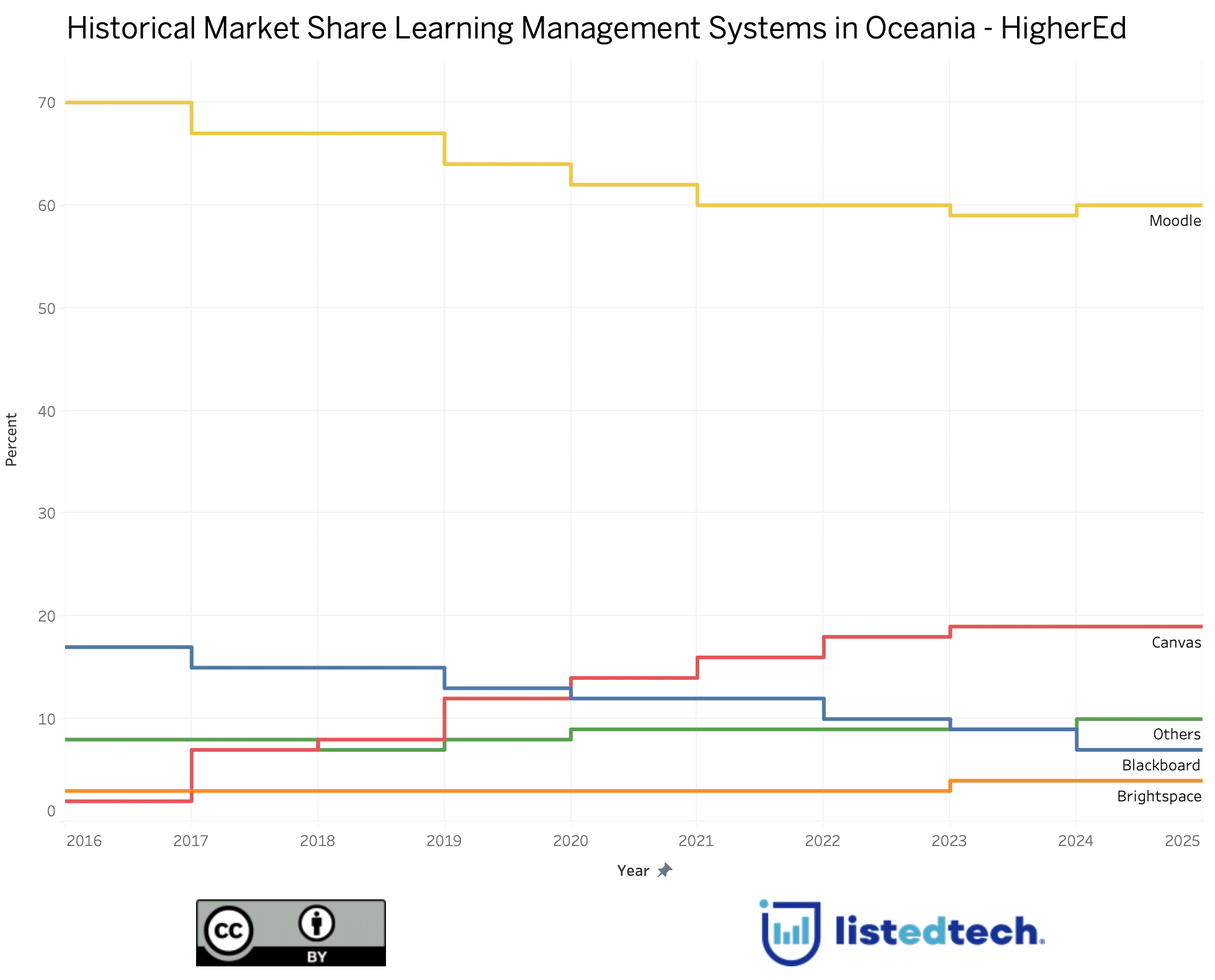

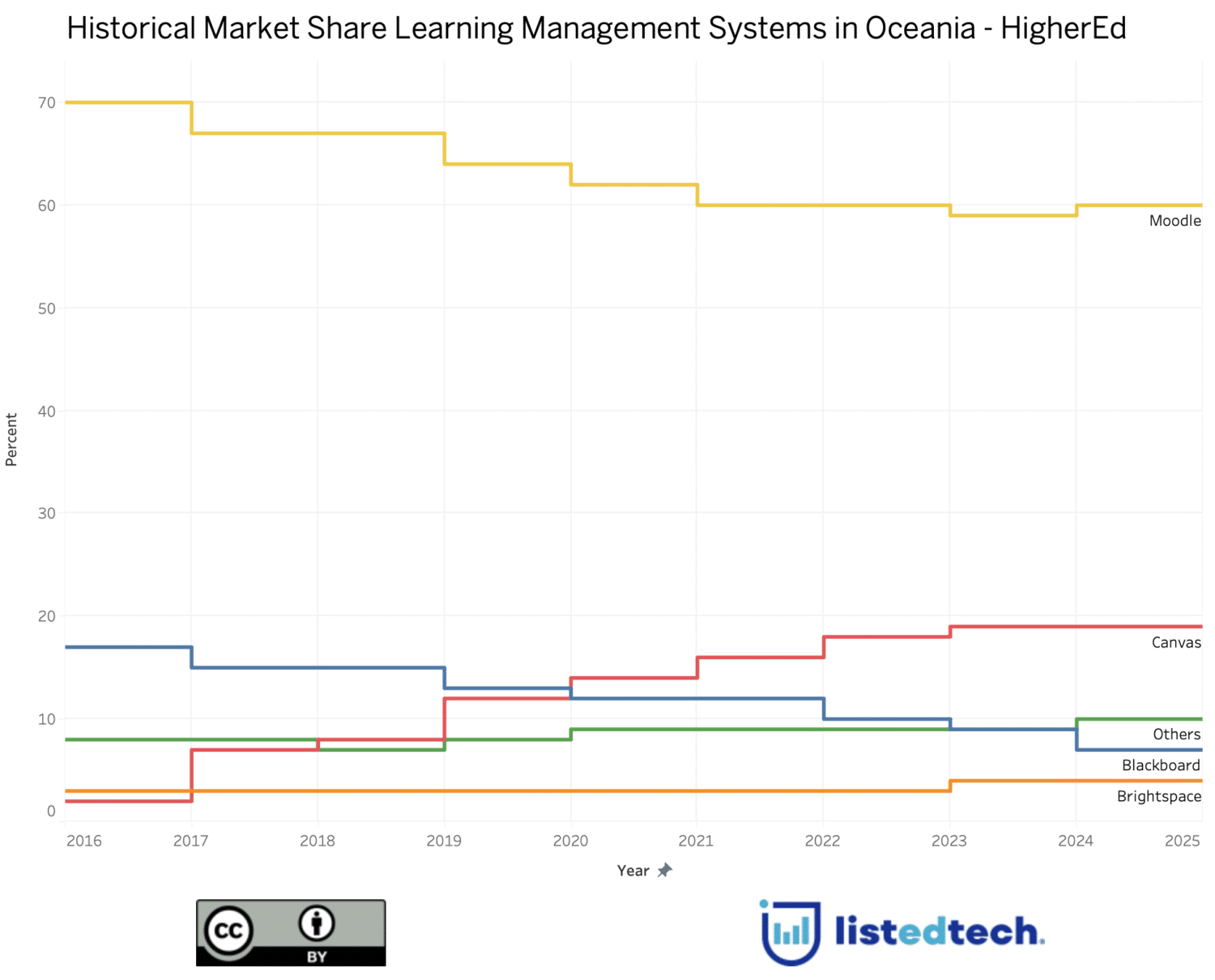

- Moodle Still Leads but is Losing Ground: Despite holding 60% of the market, Moodle’s share has declined as institutions turn to cloud-first solutions.

- Canvas is Rapidly Expanding: With a fivefold increase in less than a decade, Canvas is now the second most used LMS in Oceania.

- AI is Shaping the Future of LMS: All major platforms are integrating AI to enhance learning, streamline teaching, and support academic integrity.

With nearly 350 higher education institutions across Australia and New Zealand, Oceania represents a distinct and evolving learning management system market. This marks our first official deep dive into the region—and it arrives at a critical moment. In this post, we trace the historical dominance of Moodle, analyze the rise of newer platforms like Canvas and Brightspace, and highlight how AI and hybrid learning are reshaping the adoption of LMS in Oceania in 2025.

A Brief History of LMS Adoption in Australia and New Zealand

Historically, Moodle has been the dominant LMS in Australia and New Zealand, due in part to its local origins—Moodle was created in Perth by Martin Dougiamas. Its open-source nature and cost-effectiveness made it the go-to solution, particularly for smaller and mid-sized institutions.

However, the market has become increasingly diversified over the past decade. Blackboard once held a solid share, but its influence has steadily diminished. Brightspace (by D2L) and Canvas (by Instructure) have emerged as strong competitors, especially among larger institutions and those seeking modern, cloud-based platforms.

Current Market Share Insights for LMS in Oceania

As shown in the graph above, Moodle retains the top spot, with about 60% of the LMS market in the region. However, its share has been steadily declining. Canvas, on the other hand, has experienced rapid growth—rising from less than 4% in 2016 to about 19% in 2025. Blackboard continues its downward trajectory, while Brightspace is slowly increasing its market share from a previously stable, modest position.

In-Depth Key Developments (2023–2025)

Moodle’s Market Share Decline

Moodle’s dominance has slowly eroded. Between 2016 and the end of 2025, Moodle lost approximately 10% of its market share in Oceania. This is part of a broader global trend of institutions exploring commercial LMS solutions with enhanced user experiences and integrations.

Canvas’ Growing Adoption

Canvas continues to gain ground in Australia and New Zealand. Its clean interface, responsive support, and frequent updates have made it an appealing option for many institutions. This is particularly true for larger universities and those offering blended or online-first programs.

Integration of AI into LMS Platforms

Artificial Intelligence is becoming a differentiator among LMS platforms. Here’s how the major players in Australia and New Zealand are integrating AI:

Brightspace (D2L)

In 2024, D2L introduced a suite of AI tools under the Lumi brand:

- Lumi Idea: Suggests discussion and assignment topics.

- Lumi Quiz: Generates quiz questions from course content.

- Lumi Practice: Creates personalized practice questions.

D2L has emphasized privacy and transparency—ensuring no user data is used to train AI models and giving institutions control over feature deployment.

→ Read more

Canvas (Instructure)

Instructure rolled out several AI features in 2024–2025, focused on productivity and equity:

- Automated discussion summaries

- Smart content translation

- Intelligent Insights: AI-powered dashboards for learning analytics.

- Enhanced search: Context-aware course search functions.

These features have improved instructor workflows while aligning with the diverse needs of institutions across Oceania.

→ Read more

Blackboard (Anthology)

Blackboard’s AI push in 2024 included the AI Design Assistant, which can:

- Suggest course structures and assessments

- Generate discussion prompts and rubrics

- Provide alt text for images

- Simulate role-play scenarios with conversational AI

These tools aim to reduce friction in course creation, though adoption in Oceania has been modest.

→ Read more

Moodle

In Moodle 4.5 (October 2024), the platform added an AI Subsystem:

- Generates content (text and images) within the editor

- Offers summarization and explanation tools for learners

- Supports policy management for responsible AI use

This framework makes Moodle more extensible with third-party AI providers while keeping it open-source and institution-controlled.

→ Read more

Hybrid Learning is the New Normal

Institutions across Australia and New Zealand are increasingly supporting hybrid and flexible learning models. The learning management system is now a central hub not just for online courses, but for supporting on-campus and remote learners simultaneously.

Focus on Academic Integrity

The push for academic integrity has also shaped the adoption of LMS in Oceania. Recent legal actions against services like Chegg in Australia have raised awareness about digital cheating. As a result, institutions are favoring LMS platforms that offer robust integrity tools and seamless integration with proctoring solutions (Source).

What’s Next for LMS in Oceania?

The LMS landscape in Australia and New Zealand has changed significantly over the last decade. While Moodle remains the major player, institutions are increasingly drawn to platforms like Canvas and Brightspace for their enhanced features, usability, and modern architectures.

As institutions face increased demand for flexibility, AI integration, and academic rigor, we expect continued shifts in LMS adoption. For now, Moodle leads in institutional count, but the other platforms may soon rival it in terms of influence and user engagement.