Following our December post on product implementations and online learners in the SIS market, we received feedback that we didn’t mention the solutions to manage students’ journeys through non-degree programs outside the “traditional SIS” model. We wrote about these solutions in January, calling them continuing education SIS.

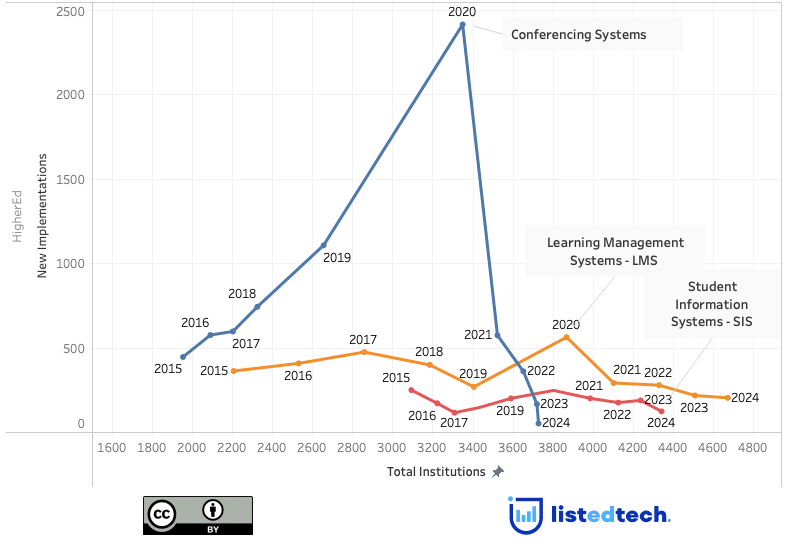

In this post, we will explore the continuing education SIS segment further. Our analysis focused on the extent to which institutions are using two SIS (or more!) but specifically, one for continuing education and another for traditional programs. We used the SIS data as an entryway into a meaningful discussion: how and why institutions choose not to extend their current SIS to administer non-degree programs, and how that relates to a growing focus on non-degree programs?

Before going further, we must address the issue of nomenclature… briefly. There are undeniably several different and commonly used terms that could describe students, program types, technologies and administrative units. By and large, a continuing education SIS is intended for administering non-degree student programming and provides functionality similar to a traditional SIS in facilitating the administration of programs. These systems also provide self-service program pages where prospective students can search, enroll, and pay for non-degree courses in an e-commerce environment.

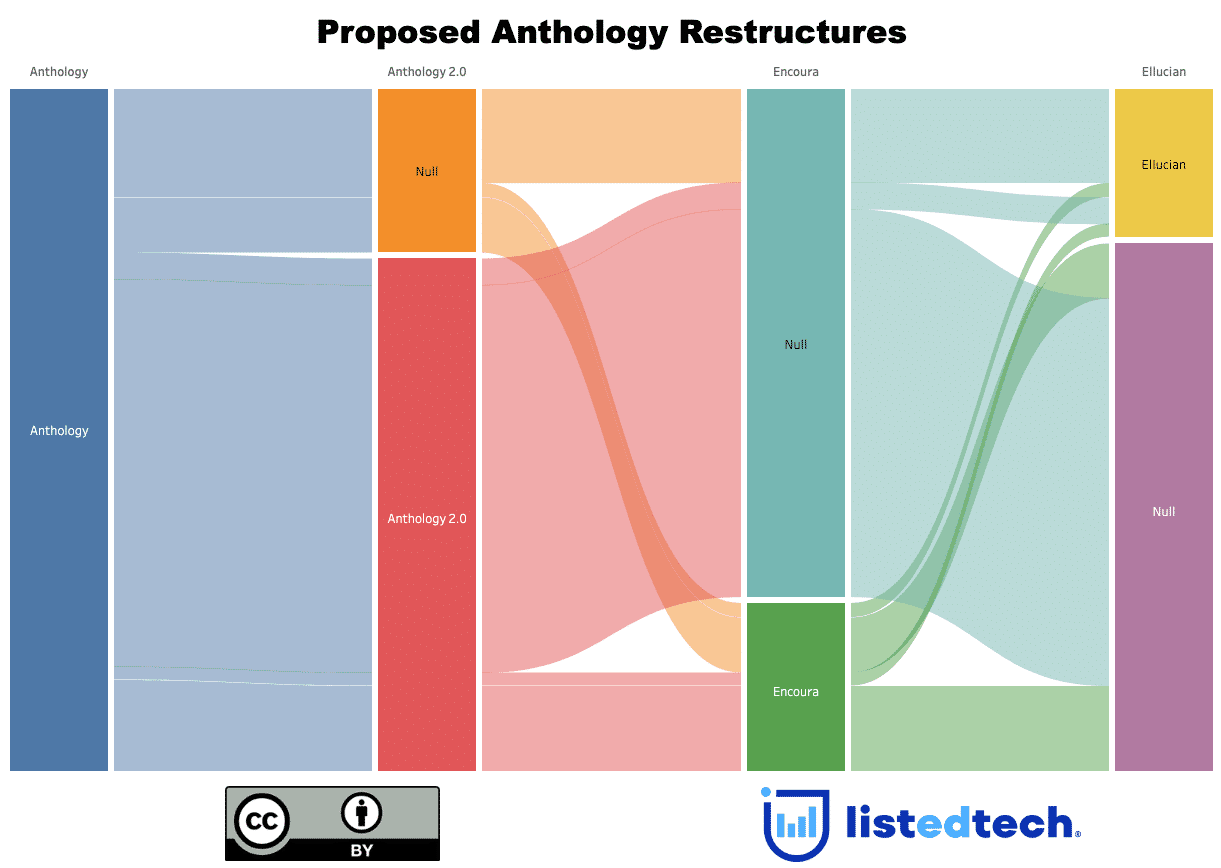

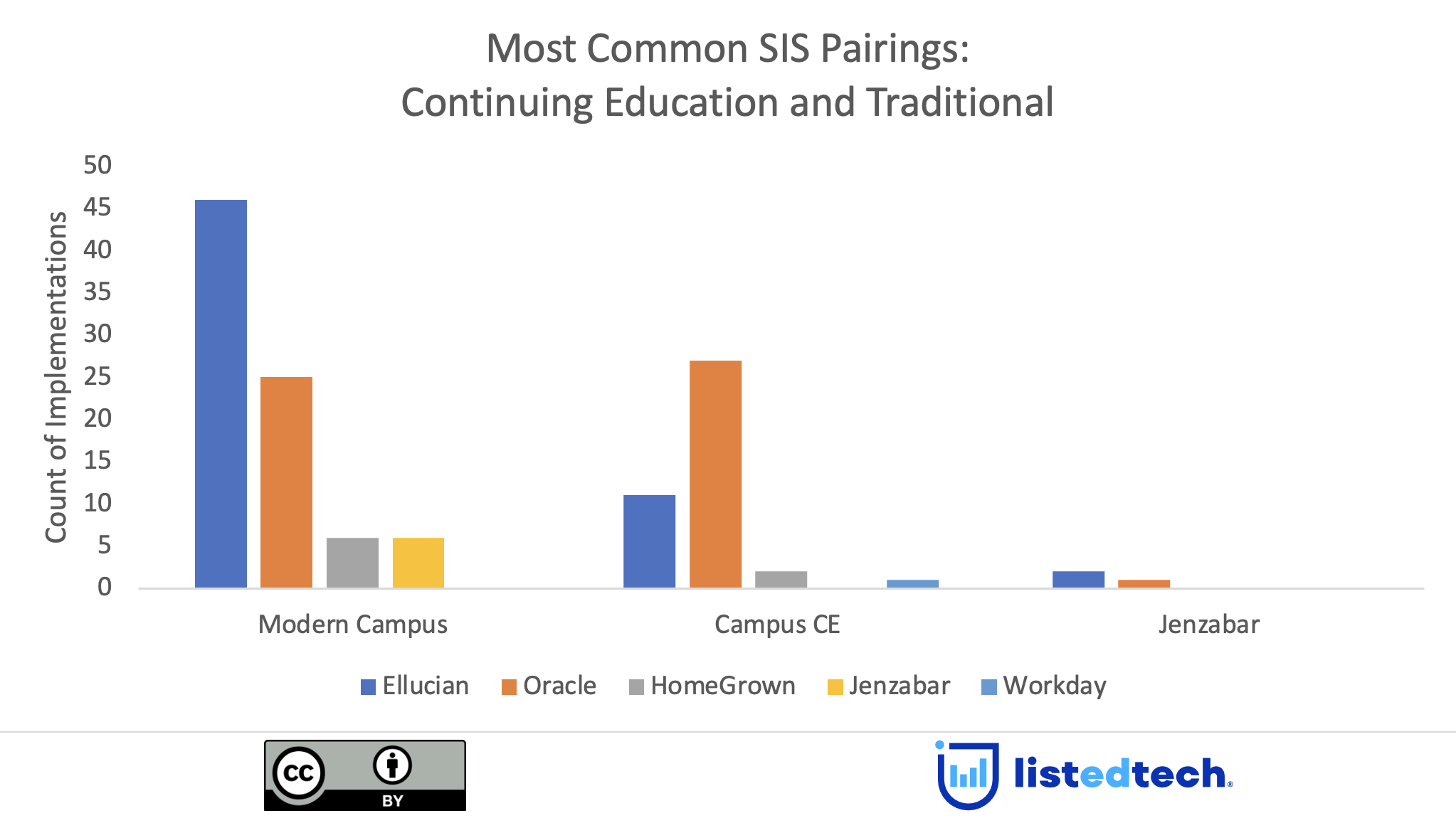

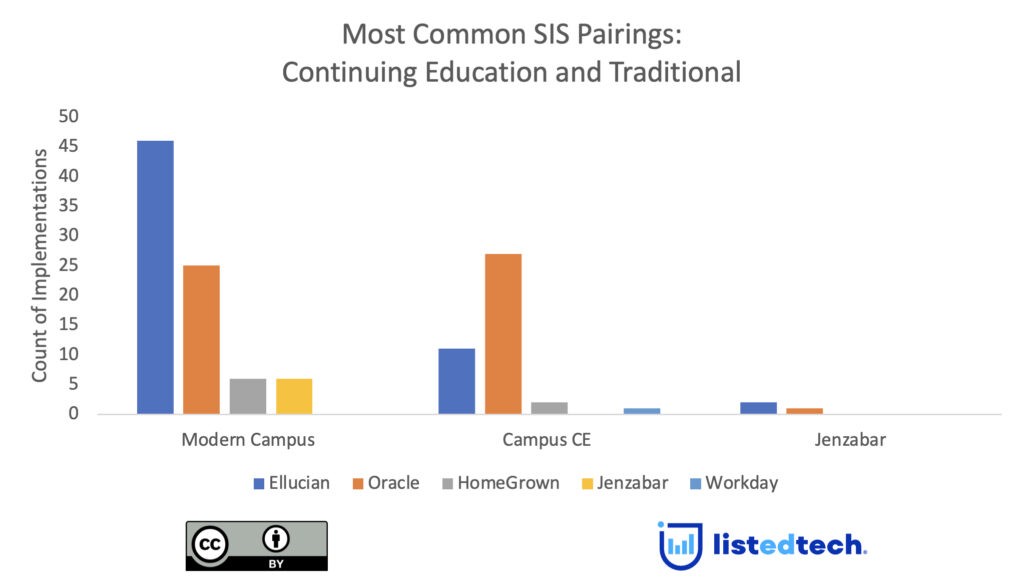

Our dataset on continuing education SIS, which is newer and thus less complete than, say, our LMS dataset, reviewed about 120 four-year public and private institutions that are both using a continuing education SIS along with another traditional SIS. This dataset is not comprehensive. As of March 2023, it contains three systems: Modern Campus (including Augustsoft), Campus CE, and Jenzabar.

Modern Campus is the most significant player in our continuing education dataset, followed by Campus CE. In the last 18 months, Modern Campus has made five acquisitions, one of which was Augustsoft. Augustsoft was one of the market-leading solutions for managing continuing education program portfolios, specifically (but not exclusively) at community colleges and regional universities. After the merger, Modern Campus is the continuing education SIS of choice among all institution types, reportedly serving nearly 2,000 schools.

Figure one below shows traditional SIS solutions used at institutions based on concurrent continuing education SIS. Though more Modern Campus institutions use Ellucian and more Campus CE institutions use Oracle for their traditional SIS, the data is insufficient to suggest a link between solutions. Modern Campus implementations were notably higher than Campus CE and Jenzabar and most likely to be among large research institutions. Additionally, Modern Campus seems to have won over larger private institutions. Though enrollment data on non-degree students is patchy, more institutions, public and private, are certainly paying more attention to this segment.

Even though many of the key SIS providers- including Oracle, Ellucian, Jenzabar, and Anthology- offer similar products intended for comparable continuing education students, many institutions have chosen a different solution. Why is this? Some hypotheses:

- The primary stakeholder in continuing education offices has historically been separate from the traditional academic programs and likely had to do more with less.

- Expanding the existing SIS to the continuing education audience may be considered more burdensome and costly. Also, it would likely cede some control to the incumbent stakeholders.

- Continuing education solutions shown here have focused on maximizing user experience from the student perspective. You can tell when you’re on a Campus CE or Modern Campus site: it’s easy to shop and ultimately enroll in courses and programs.

- For traditional SIS vendors, it may simply not have been worth it. The non-degree market is just smaller, if not in students (no one really knows!), than certainly in tuition revenue.

Though not within this dataset, the case can easily be made that major higher ed MOOC platforms such as EdX and Coursera are the largest continuing education SIS by leaps and bounds. Both attract tens of millions of students and offer many functionalities of an out-of-the-box solution. Of course, there are both challenges and opportunities that come with having learning content (degree-granting or not) hosted on a third-party platform.

The importance of solutions intended to serve non-degree and continuing education students in Higher education will only continue to grow. Institutions increasingly offer non-degree programs as the general population seeks further education to re-skill and upskill. Through the lens of mission, many institutions within this dataset must educate these student populations- if not through degree programs, then through non-degree programs! Through the lens of enrollment and revenue growth, non-degree programs provide an alternative to degree markets that are only getting more competitive. Also, students completing continuing education programs (especially those designed to serve as a bridge toward degrees) likely pass through the enrollment funnel at a higher applicant-to-enrollment conversion rate than almost any other prospective student audience.

Using different SIS for continuing education and the traditional needs reflects various stakeholders’ and functional groups’ priorities and core business. It begs the question: would there be a benefit to a single system being used to manage all types of students? As non-degree enrollments and options multiply, the potential use case and opportunity for bridging some of the work two solutions perform will likely grow. Will tired traditional SIS clients see an opening in implementing their continuing education SIS across campus, should the functionality be right? Will we see a rise in bridging solutions that effectively capture important data from one SIS to share with stakeholders within another function area using another? Time will tell. Never a dull moment in edtech.