Over the past few months, we received a lot of requests to update this blog post. We agree that for LMS vendors and institutions in the process of changing their LMS, this post could be of interest. However, we have noticed that predicting what an institution will select for its next LMS is not just about having a good algorithm. Some readers may be disappointed to learn that we won’t make new predictions in this post until we update our algorithm. (We will still update our table with previous data!) We will focus our post on the lessons learned from this exercise.

- The first lesson learned is that IT peer institutions are not an exact science. Some products are better predictors than others when we look at specific products. For instance, using BI systems to predict LMS selection is often irrelevant. As previous versions of this post mentioned, we focused our IT peer institution on eight core products. This set of predictors could change. As James raised in his post on key drivers of technology implementation, “the most significant driver in predicting which LMS an institution has implemented is another technology.” But this does not mean that all IT systems are governed by the same tech stack.

- Another aspect of our misleading predictions was how we counted implementations. For instance, when a multi-campus institution selected an LMS, we counted them as multiple decisions, even though the decision was made centrally for all campuses. We now use a new approach: if it’s one decision, it’s one prediction.

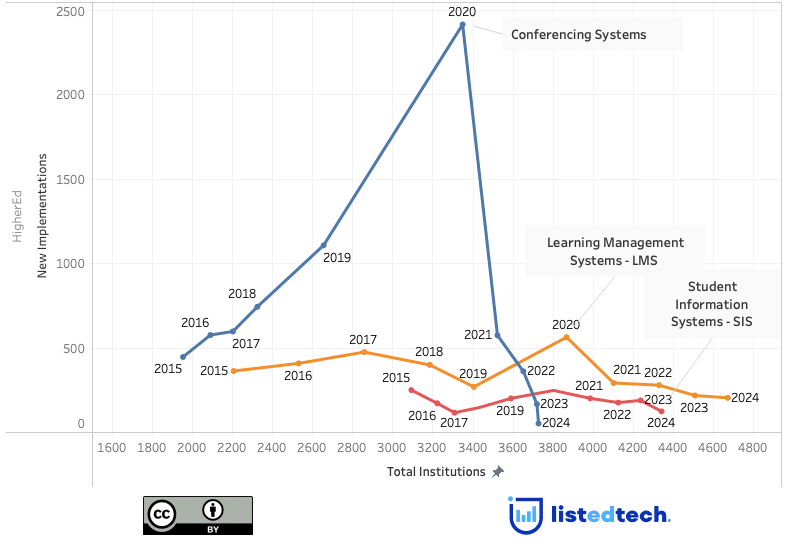

- Another challenge we encountered when looking at historical implementations was that we looked back 6-7 years to see what peer institutions implemented. Some product categories vary greatly from one year to another. We now look at 2-3 years in the past. A good example of this situation is D2L. The company only represented about 15% of new implementations three years ago. In 2022, it was around 30%.

While working on the algorithm, we validated it using publicly available RFP data as a starting point. We verified our internal predictions using the announcements made by institutions, companies or our scrapers.

As you can see in the table below, we have listed RFPs that we have found dating back to 2019. This list is only for LMS selected in higher education in North America.

We will validate our predictions when we discover an announcement or learn that an institution uses a new LMS. We will only include new system implementations in this prediction table. If an institution does not select a new system or keeps its current system, we will not count it since some RFPs are often RFIs.

List of LMS Predictions in HigherEd

Percentage of good LMS predictions as of March 6, 2023: 16 out of 25 (64%)

Here is a list of ListEdTech predictions and the product selected by the institutions.

| Institution Name | ListEdTech Prediction | Institution Selection | Valid Prediction |

| Brock University | Canvas | Brightspace | No |

| Carleton University | Brighstpace | Brightspace | Yes |

| Central Connecticut State University | Canvas | NA | |

| Chemeketa Community College | Canvas | Canvas | Yes |

| Framington State University | Brightspace | Canvas | No |

| Holyoke Community College | Canvas | Canvas | Yes |

| Illinois Central College | Brightspace | Canvas | No |

| Illinois Valley Community College | Canvas | Brightspace | No |

| Kent State University | Canvas | Canvas | Yes |

| MacEwan University | Brightspace | NA | |

| Metropolitan Community College-Kansas City | Canvas | Canvas | Yes |

| Metropolitan State University of Denver | Canvas | Canvas | Yes |

| Mississippi State University | Canvas | Canvas | Yes |

| Mohave Community College | Brightspace | Canvas | No |

| Mount Royal University | Brightspace | Brightspace | Yes |

| Northeast Ohio Medical University | Canvas | Canvas | Yes |

| Southeast Missouri State University | Canvas | Canvas | Yes |

| St. Cloud State University | Canvas | NA | |

| University of Illinois at Chicago | Canvas | Canvas | Yes |

| University of Kansas | Canvas | Canvas | Yes |

| University of New Mexico | Canvas | Canvas | Yes |

| University of Rhode Island | Canvas | Brightspace | No |

| University of Tennessee | Canvas | Blackboard | No |

| University of Victoria | Brightspace | Brightspace | Yes |

| Virginia Commonwealth University | Canvas | Canvas | Yes |

| Western State Colorado University | Canvas | Canvas | Yes |

Here are some predictions we have made with the new data.

| Institution Name | ListEdTech Prediction | Institution Selection | Valid Prediction |

| Black Hills State University | Blackboard | ||

| Bridgewater State University | Brightspace | ||

| City University of New York | Canvas | Brightspace | No |

| Dakota State University | Blackboard | ||

| Dallas College | Canvas | Brightspace | No |

| Northern State University | Canvas | ||

| South Dakota School of Mines and Technology | Canvas | ||

| South Dakota State University | Canvas | ||

| The University of Texas Health Science Center at Houston | Brightspace | ||

| University of Maryland, College Park | Brightspace | ||

| University of South Dakota | Canvas | ||

| University of Texas at Austin | Blackboard | ||

| University of Windsor | Canvas | Brightspace | No |