For the past couple of years, we have been tracking RFP data to help us better understand future trends in system implementations. Because of the nature of a request for proposals, this data also gives us an additional indicator of which institutions might change their systems, which is our core business.

Since the first iteration of this post, we have amassed more RFP data in Canada and the USA. From two years in March 2022, we have compiled four years (2019 to 2022). Please remember that the RFP data does not represent most of the system implementations. It only accounts for about one-third (revised number) of all implementations. Therefore, we have to read this table with a grain of salt.

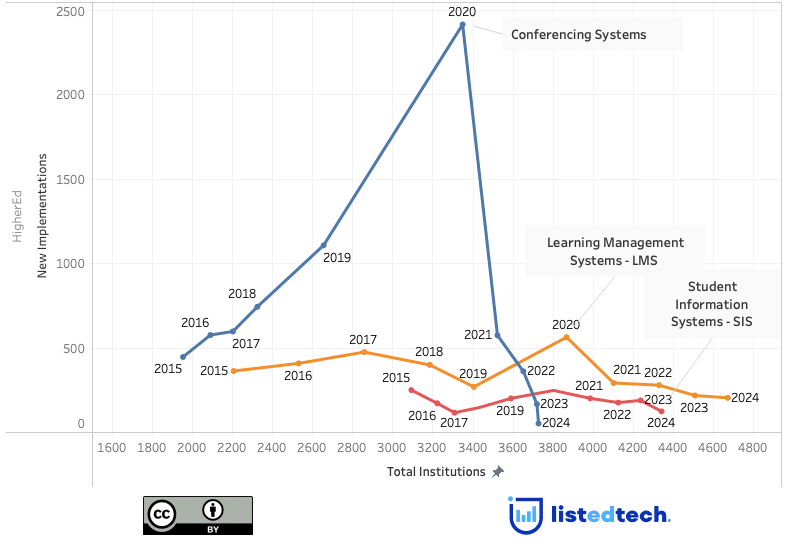

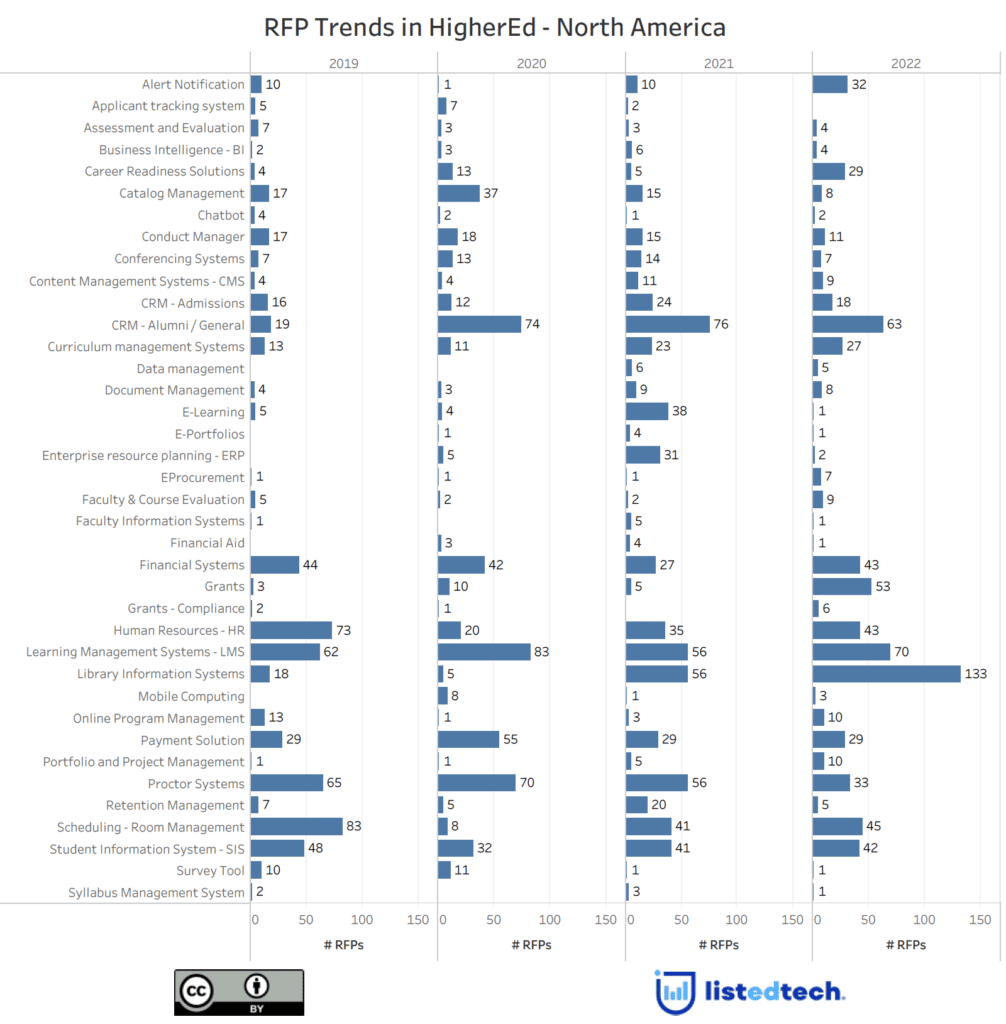

HigherEd Data: Two Distinct Groups

Looking at the four-year dataset, we see some product categories being more active than others. Grant systems are boiling. In March 2022, we found 3 RFPs in this product group. As of November 2022, we have 53 RFPs, an increase of almost 1000% compared to 2021. Library information systems see a similar boom: we have compiled 133 RFPs for 2022, an increase of 138% to 2021.

We don’t observe these impressive growth rates in all product categories. Even if we are still suffering the repercussions of the pandemic, we notice a slowdown in RFPs for proctor systems. Institutions launched 65 RFPs in 2019, 70 in 2020, 56 in 2021 and “only” 33 this year.

Financial systems, SIS, and HR systems RFPs have remained steady since 2019. Since they are central to their administration, institutions often prepare RFPs in these groups many years in advance. As previously mentioned, the pandemic forced many institutions to launch RFPs to respond to online learning. The unprecedented crisis explains the rise in RFPs in 2020 for learning management systems (+34%), proctor systems (+8%) and CRM General (+289%). We can speculate that the online delivery of programs puts pressure on institutions to communicate effectively with their students. CRM systems are there to respond to this need.

The four years of data for the Higher Education sector shows that most product groups have less than 10 RFPs per year. We notice this situation for the following groups: assessment and evaluation, business intelligence, chatbots, data management, document management, e-portfolios, e-procurement, faculty and course evaluation, faculty information systems, financial aid, grants – compliance, mobile computing, and syllabus management systems. These categories represent 34% (13 out of 38) of the categories for which we have RFP data.

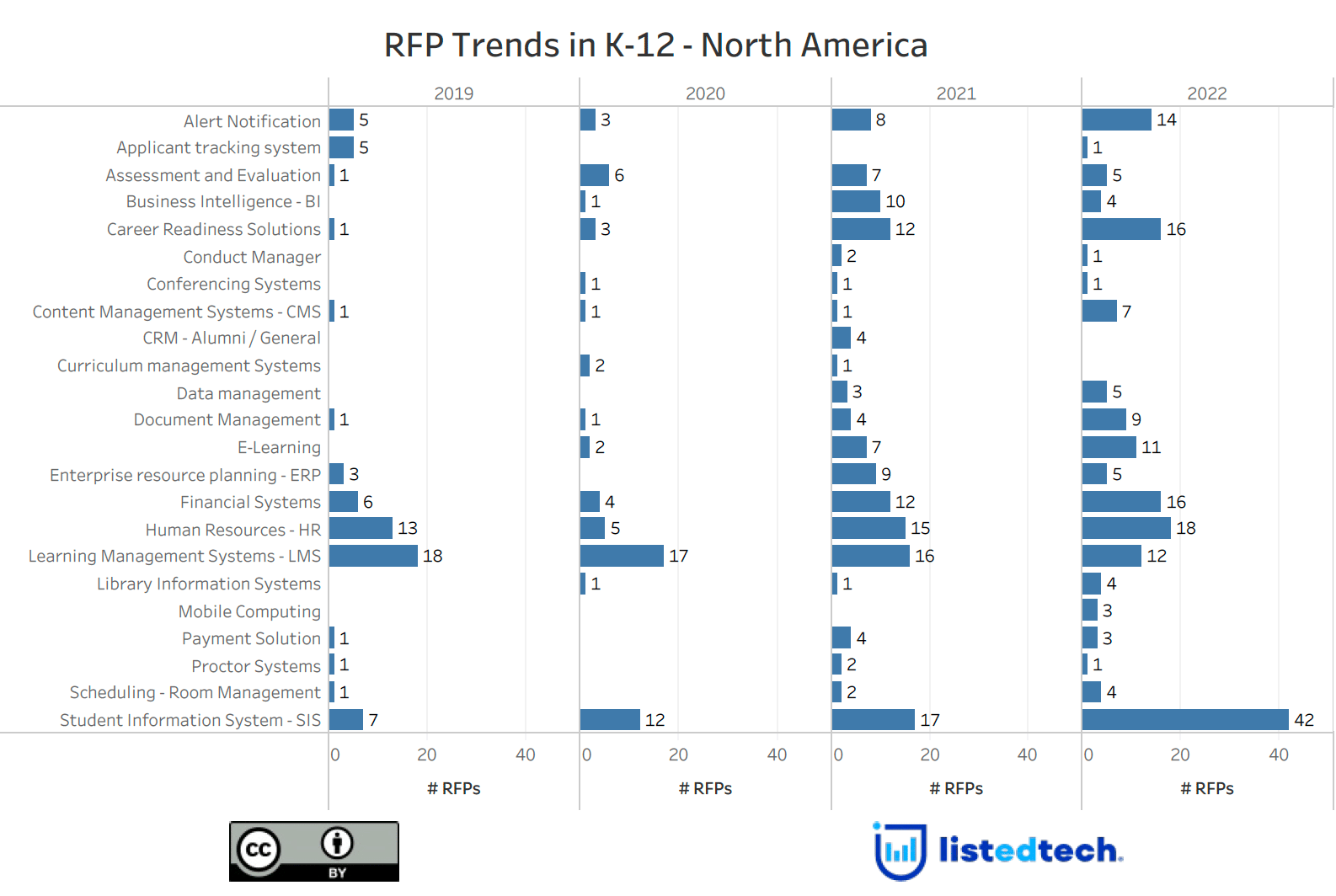

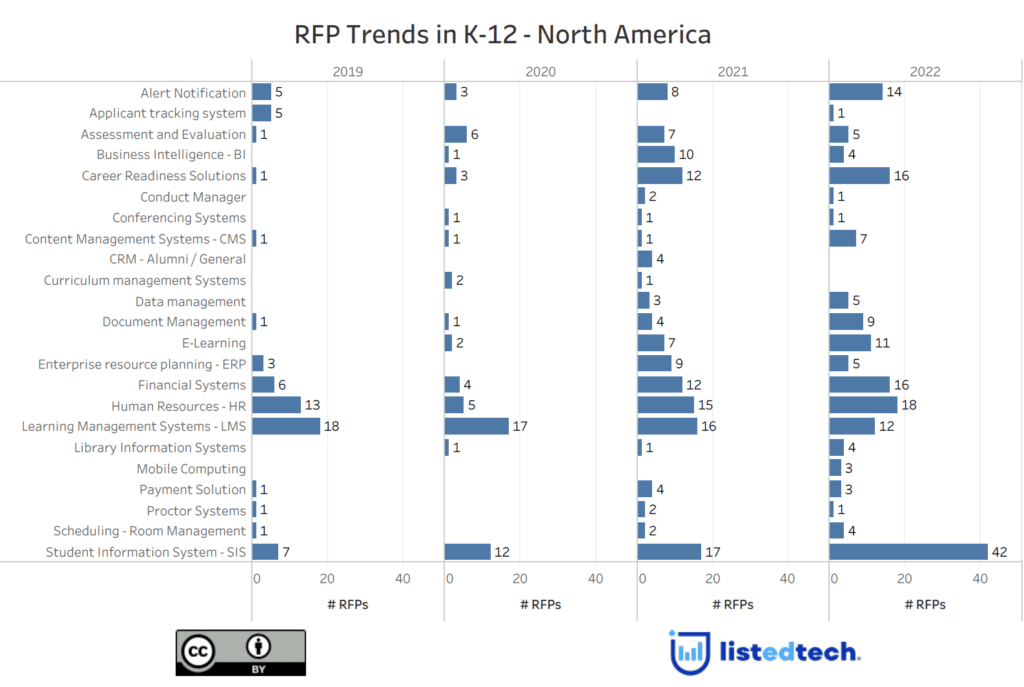

K-12 Sector: Following Some HigherEd Trends

For the K-12 sector, we notice that SIS, HR, Financial and Career Readiness Solutions are leading the RFP count for 2022. We also see a trend for K-12 numbers in that school districts are launching more RFPs yearly. In addition to the RFP leaders already mentioned, alert notifications, content management systems, data management, document management, e-learning, library information systems and scheduling – room management product categories have surpassed last year’s numbers.

Since not all institutions or school districts have to use RFPs when looking for IT systems, we must be careful when interpreting this data. Now that we have a bigger pool of RFP data, we can establish market trends in some product categories.