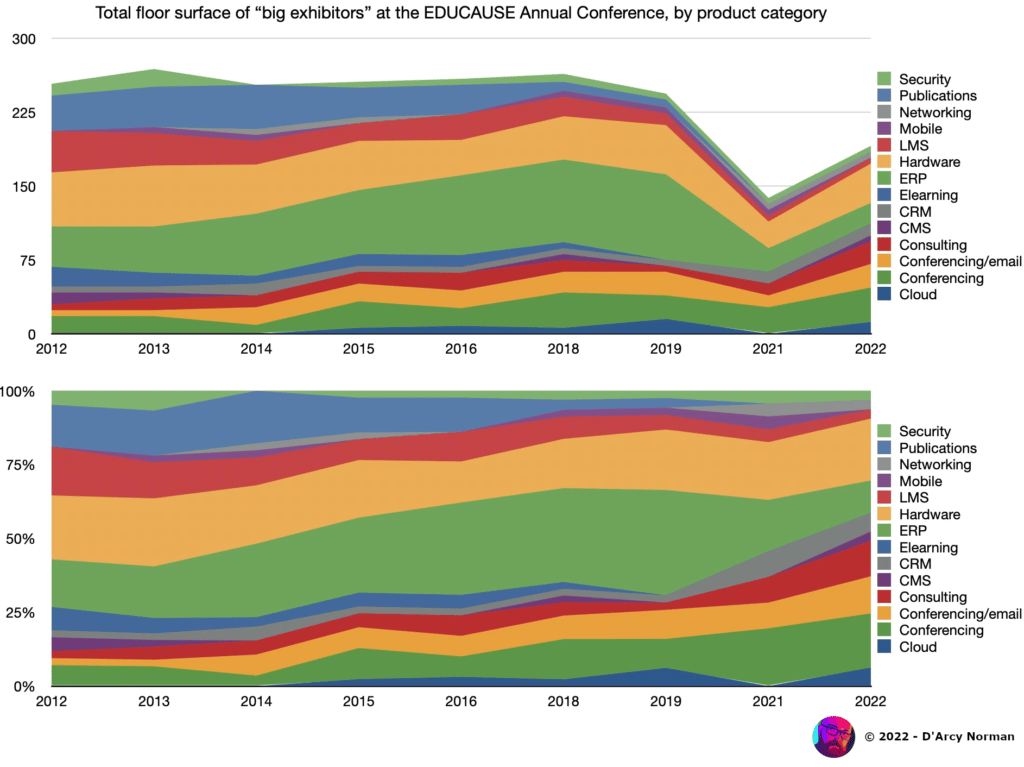

Last week’s post got lots of coverage. Some bloggers played with the data to build alternative versions of some graphs, while others commented on the post and generated many remarks on reposts. I would like to thank everyone who shared the Educause post or commented on it. It’s good to see that the edtech community is active and interested.

I specifically enjoyed the work done by D’Arcy Norman, Associate Director of Learning Technologies & Design at the Taylor Institute for Teaching and Learning, University of Calgary. He created an alternative visualization for the importance of each product category over the years.

As you guys know, I attended the Educause annual conference in Denver last week. During the conference, I received much feedback on my analysis when browsing the floor from both existing clients and other companies. In general, everybody found the analysis amusing, and some provided feedback on my thoughts.

- “Educause’s rankings generally go by seniority, meaning your ability to pick a big booth is often dictated by your position on the seniority list. Sometimes, big spots might be left, but they are in terrible floor areas. Given the expense of filling such a space, it’s a ‘why bother’ situation.“

- “More interestingly, I’d love to know the number of ‘side meetings’ happening in hotels across Denver this week. Those big companies who used to do big booths have more often shifted to completely overtaking the adjacent conference space in other hotels to do their specialized meetings. Try finding a CIO in the wild on the trade show floor. It doesn’t happen.”

In addition to booths, Educause rents meeting spaces to do private one-on-one meetings. Contrary to other conferences, no company I talked to rented suites in nearby hotels.

Holding Educause Conferences: a Challenge for Several Reasons

It was said that during Covid, Educause had to do a fair amount of layoffs, showing that the annual conference is pivotal to their business model. From what I heard, around one-third of Educause’s total yearly budget comes from the annual conference’s floor plan revenues and sponsorship, the rest of the revenue being mostly membership fees.

Another topic to mention when discussing the floor plan is the actual price Educause pays to hold such events. The Educause executives try to keep exhibition hall pricing fairly stable, even if the pricing does go up every year. Since Educause does not own any conference facilities, these venues can dictate the price per square foot. These locations are themselves subject to union policies, city taxes and property management regulations that could influence the pricing charged to Educause. These reasons could probably explain why the annual conference hasn’t visited New York for several years.

I’ve been to over 15 Educause annual conferences and noticed that this event is definitely a gathering for IT vendors and institutions. Over the years, I’ve heard all types of stories, and not all are good. As with many organizations of this size, Educause has a number of rules that limit what vendors can and cannot do. But it was basically unanimous that, this year, the pricing was competitive for the number of attendees. As many vendors mentioned during our conversations, they hoped to be back next year.