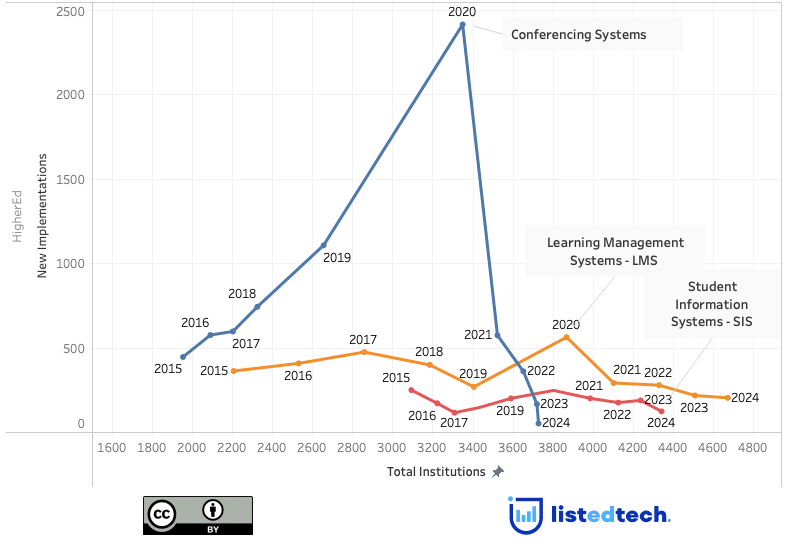

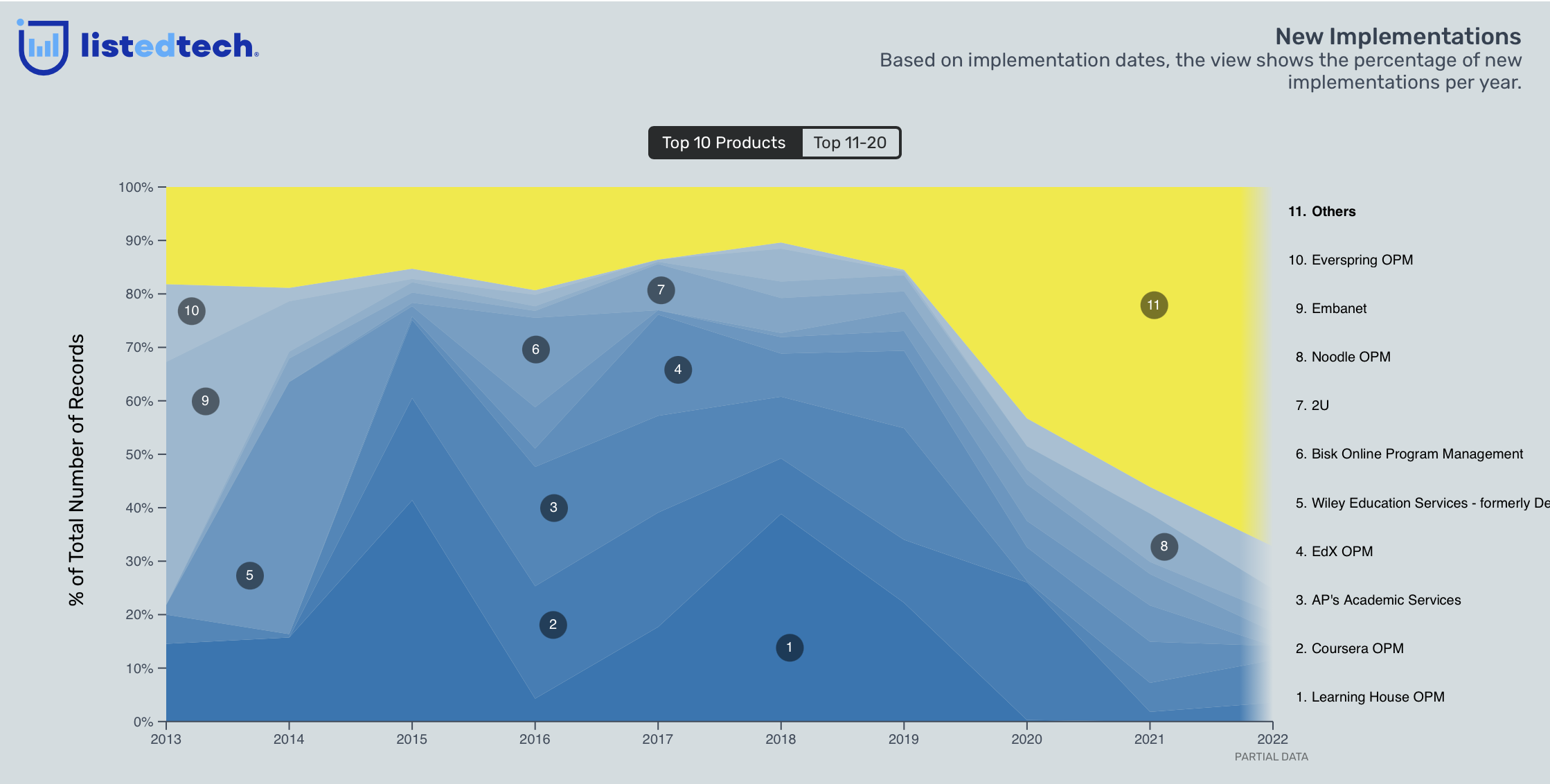

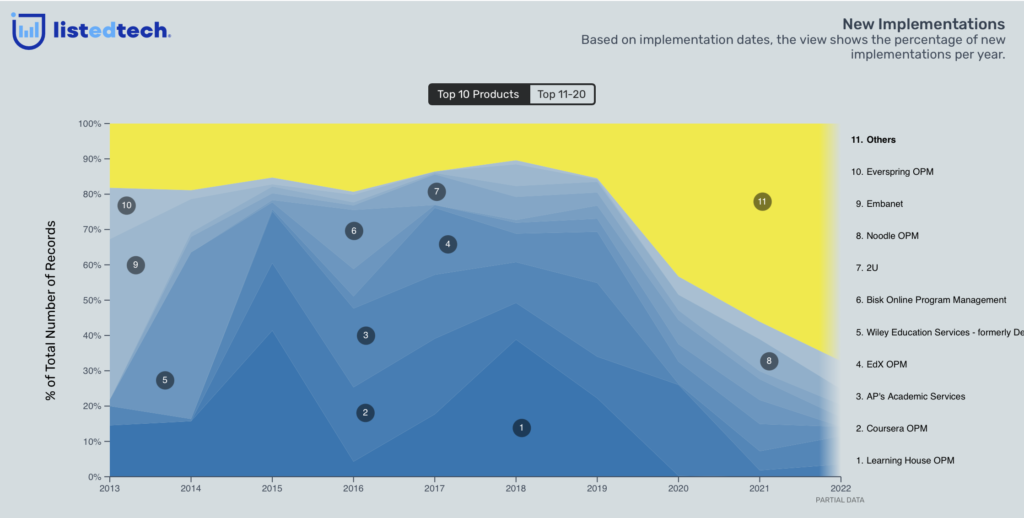

The Online Program Management (OPM) product category has changed in the past few years. Contrary to most product groups, the OPM market is now dominated by smaller players, grouped in the ‘Others’ in our graph jargon. Where are the previous leaders? Has the pandemic altered this category?

Dr. Carl Sagan once said: “You have to know the past to understand the present.”. Therefore, let’s look at the historical new implementations in the OPM product category.

In all product groups, the Others usually represent a fairly stable range over time. In some categories, they constitute between 10 and 20%, and in others, 30 to 40%. This stable representation occurred in the OPM group until the pandemic struck. Getting between 10 and 20% since 2013, the Others amassed 40% of new implementations in 2020 and 50% in 2021. This year, our preliminary data indicate that they will hit 55%.

Previous bigger players reduced their market share or completely vanished during that time. Noodle is one of the few solutions (of the bigger players) that saw an increase in the past few years. On its website, it is mentioned that the OPM industry has been working with the same model since its inception. Noting the technological gap between the needs and the solutions, the Noodle team has created a new product to respond to HigherEd needs. According to its website, it has “launched as many degree programs with top universities in the past three years as have all conventional OPMs combined.”

OPM Acquisitions That Led to This Transformation

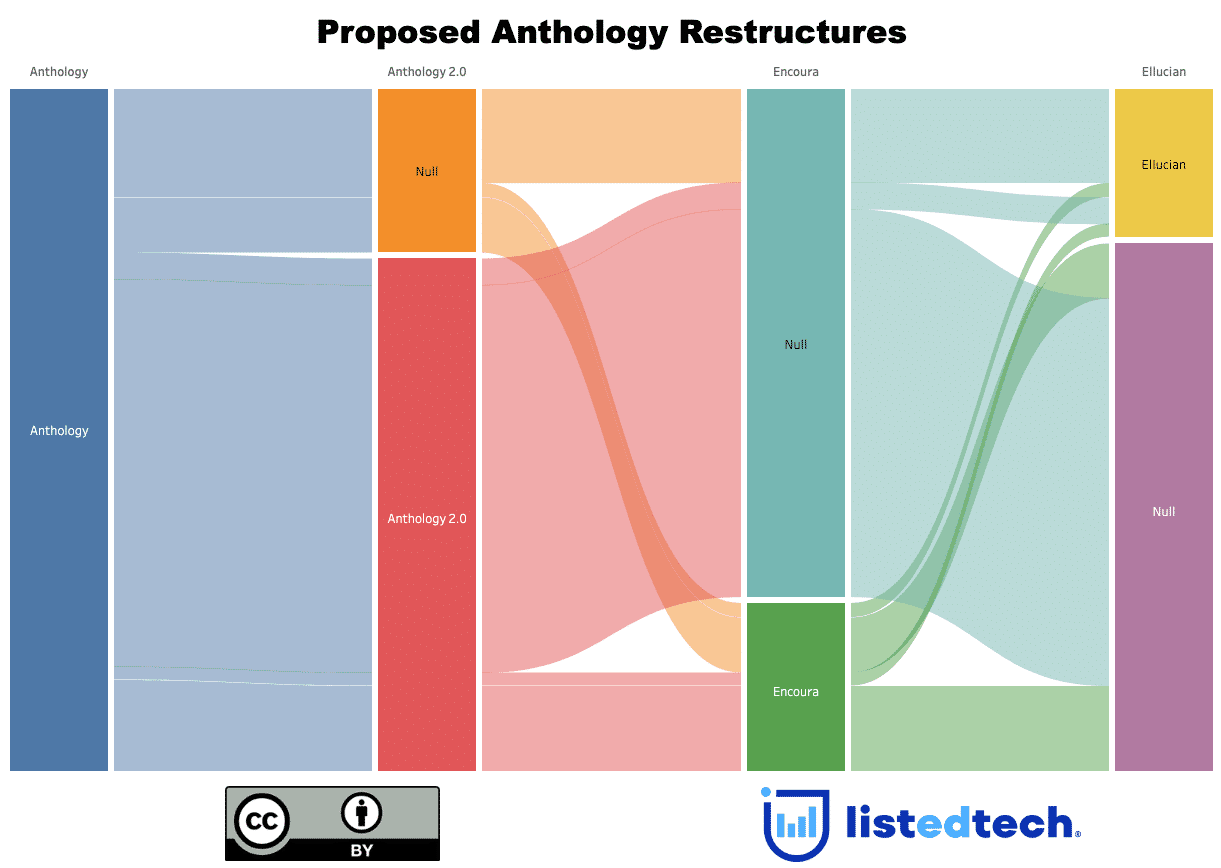

We can certainly explain why some of the leading solutions disappeared. In October 2018, Wiley University Services announced the acquisition of Learning House OPM. Completed in July 2019, this explains why, as of 2019, Learning House OPM did not appear as a new OPM implementation. The same thing happened when Wiley purchased Deltak, the then-leading OPM solution, in 2012.

Another acquisition can also explain the disappearance of Embanet. This one also dates from 2012, when Pearson bought EmbanetCompass for $650M. Being the leading solution, the Embanet product remained active in the OPM category until 2019. We can imagine that Pearson used the name to showcase its product suite.

Who Are the Others?

When a market changes, it is sometimes hard to predict what will become the next big thing. Here are some of the smaller players, included in the Others:

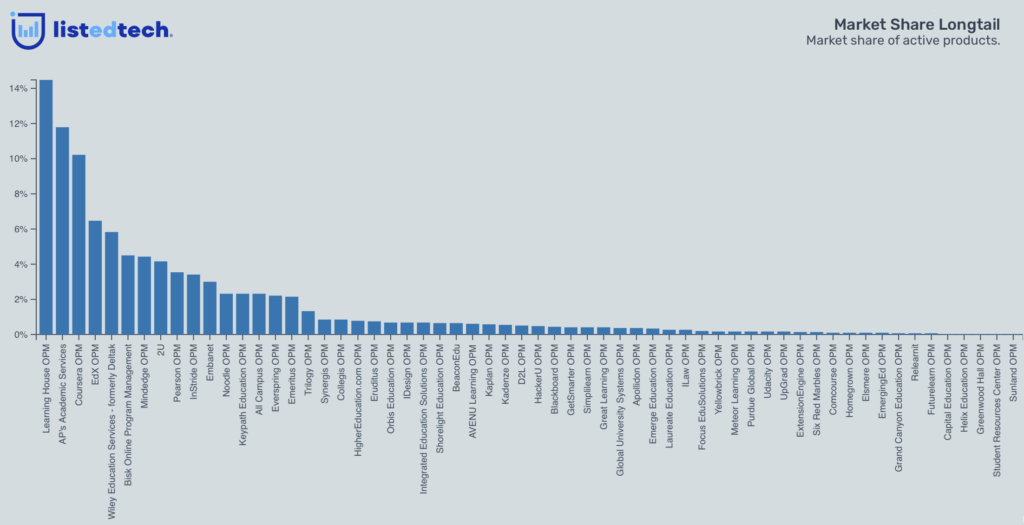

There is more to the story than these few names. As we can see in the market share longtail, OPM has dozens of solutions, most of them being smaller players like the ones we just named. In the OPM category, the implementation boom due to the pandemic only lasted one year. Since 2021, the implementation numbers have been back to pre-pandemic levels. The OPM product category will continue to adapt to new learning styles and delivery methods. As we showed in our March 2022 post, contracts are on the rise, and we don’t see a reason why it should stop.