In educational technology, the necessity of cultivating strategic business partnerships is undeniable. As classrooms evolve into dynamic digital environments and learners navigate an increasingly interconnected world, the complexities of integrating technology seamlessly into education become apparent.

While considering educational technology, we define a business partnership as a collaborative arrangement between companies aimed at advancing innovation and solutions in the education sector. Most partnerships entail shared resources, expertise, and technology to develop and deliver products or services that address specific educational needs. They often involve joint ventures, strategic alliances, or co-development agreements to leverage each partner’s strengths for mutual benefit.

By joining forces with a partner, companies can improve their solutions and contribute to the success of students or institutions. In this post, we explore how edtech business partnerships are currently set up, using two product categories: enterprise resource planning and learning management systems.

Context

In today’s digital education, classrooms are no longer confined to physical spaces but extend across virtual environments, offering students access to knowledge and resources. Yet, behind this seamless integration of technology lies complex challenges, from ensuring equitable access to educational tools to navigating the ever-expanding landscape of digital solutions.

At the heart of this complexity resides the critical need for synergy — a convergence of minds, resources, and expertise to navigate the intricacies of edtech implementation effectively. Business partnerships in education technology recognize that no single entity possesses the solution for all the problems facing modern education.

These alliances offer the opportunity to shape the future of education itself. In a world that evolves in a knowledge economy, where the ability to adapt and thrive in an ever-changing landscape is paramount, the role of technology in education cannot be overstated. In this endeavor, partnerships serve as the catalyst for transformation.

Methodology

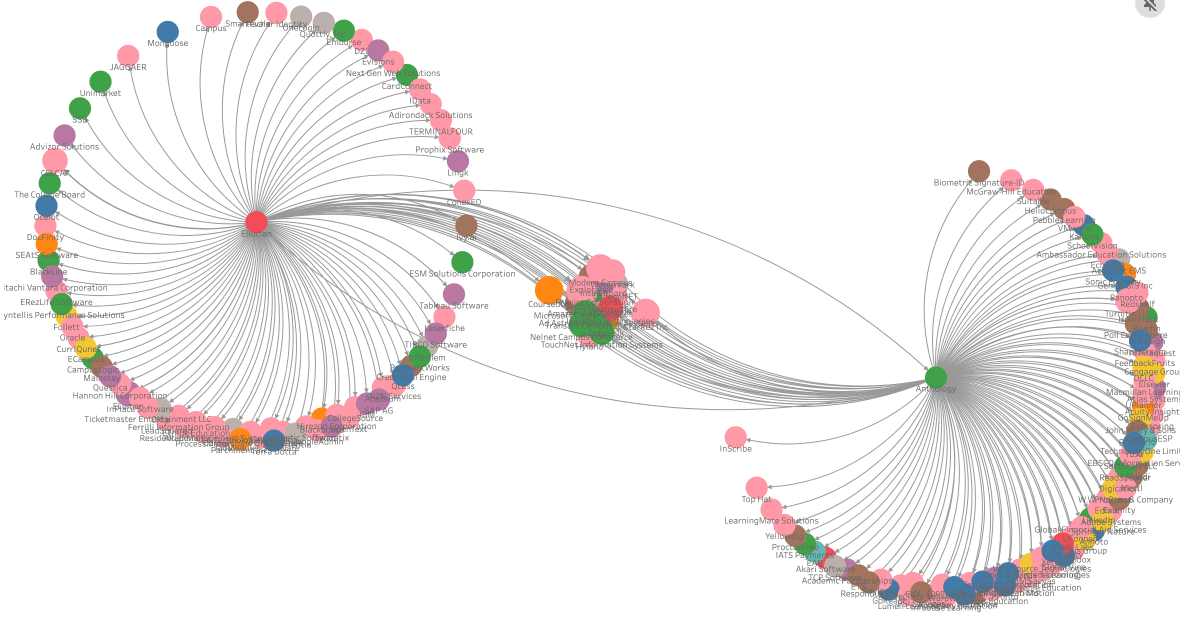

This research is part of our commitment to extend our database to other spheres of educational technology. In the past few months, we looked at a few dozen company websites to collect all publicly advertised partnerships to better understand the dynamics between companies. So far, our testing phase has allowed us to track 2,300 partnerships, and we wanted to share our preliminary results.

Findings: Business Partnerships Vary from One Product Group to the Other

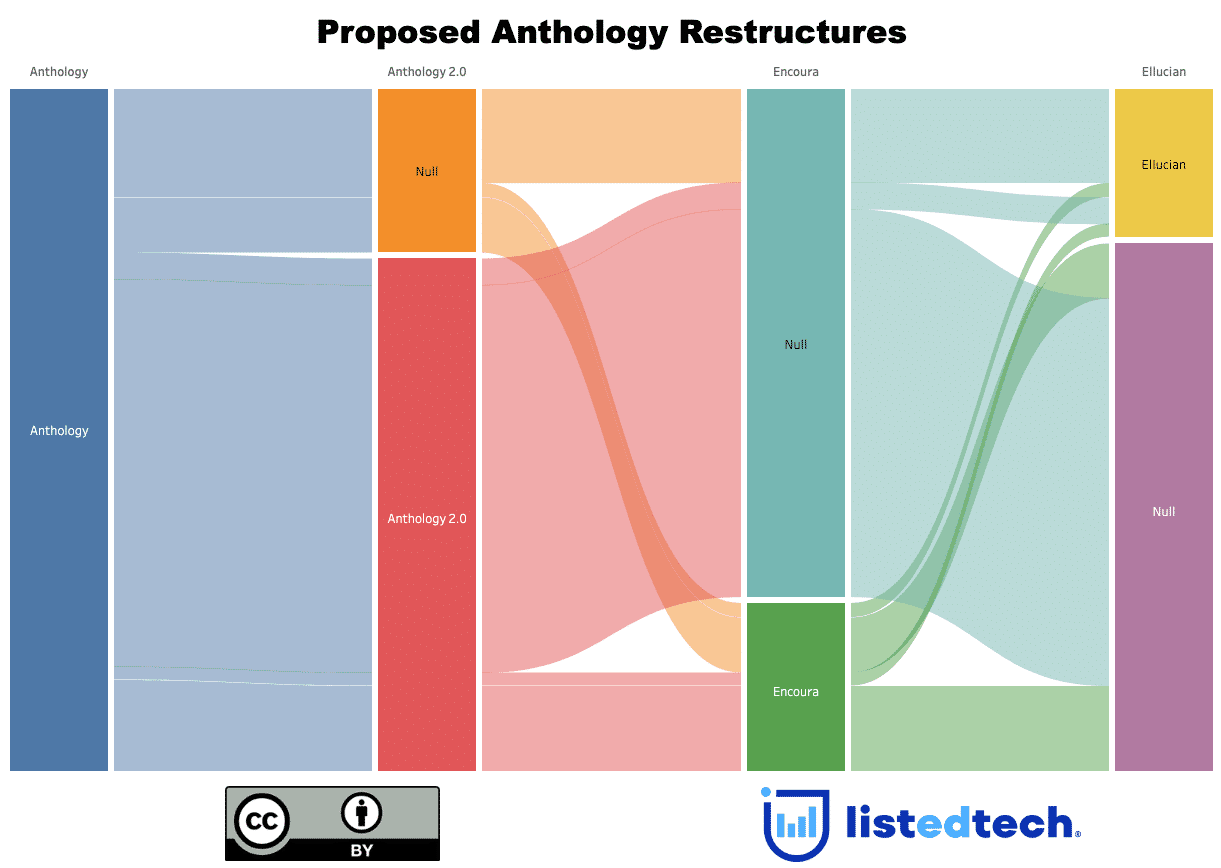

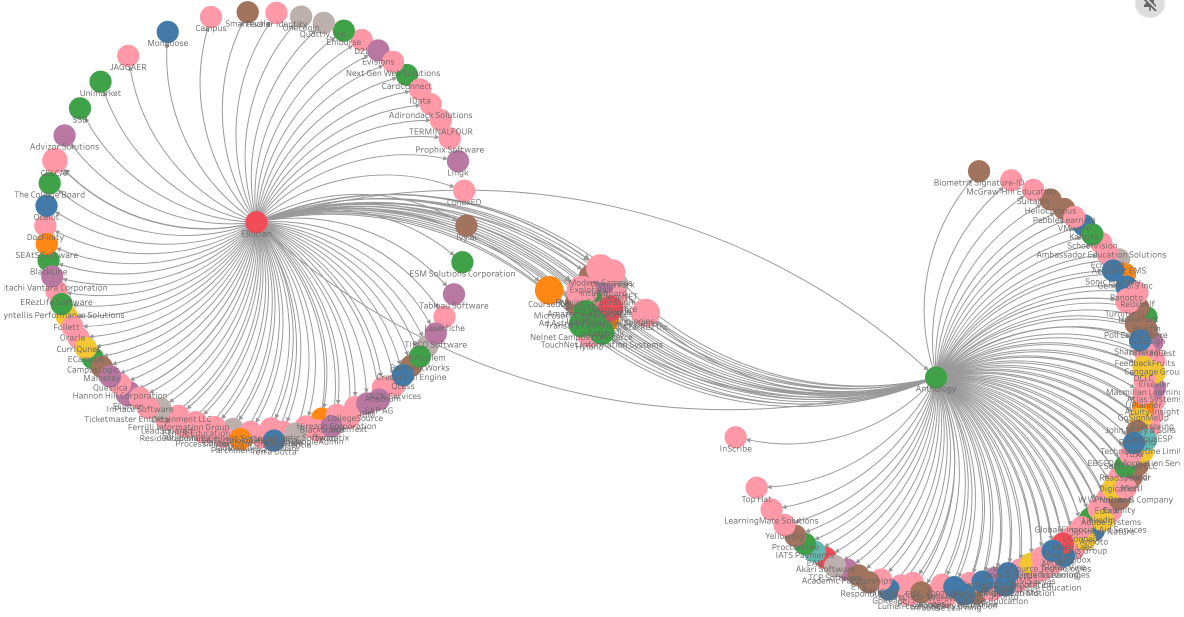

Business partnerships in education are built around individual ecosystems. In the ERP product category, we have analyzed all partnerships for Anthology and Ellucian. One may ask: why select these two companies and not Oracle, for instance? Anthology and Ellucian have the bulk of their business in education, while Oracle has a much more diverse portfolio. As we focus our venture exclusively on education, it is logical to perform this analysis with these two players. As shown in Figure 1, in the ERP product category, companies are usually linked with either Ellucian or Anthology; although some companies have signed agreements with both. These companies are mostly in the Financial Management and Enhancement (Retention, LMS) product groups.

Figure 1: Examples of Partnerships in the ERP Product Category

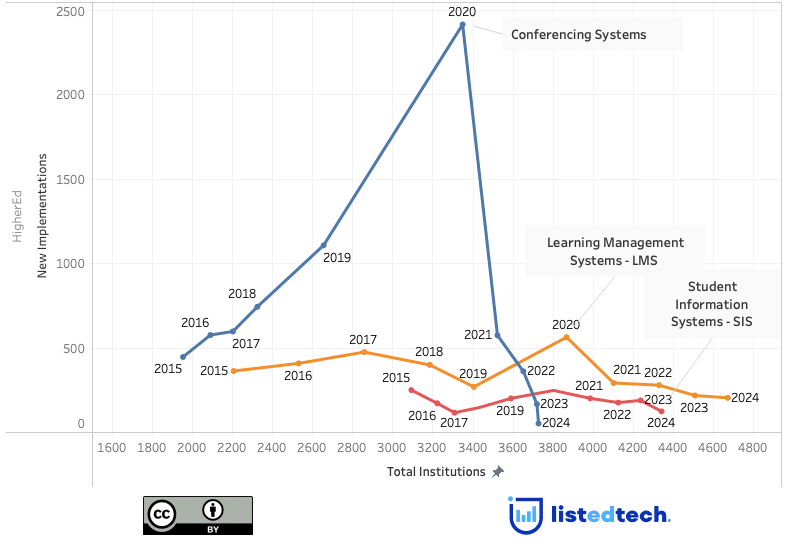

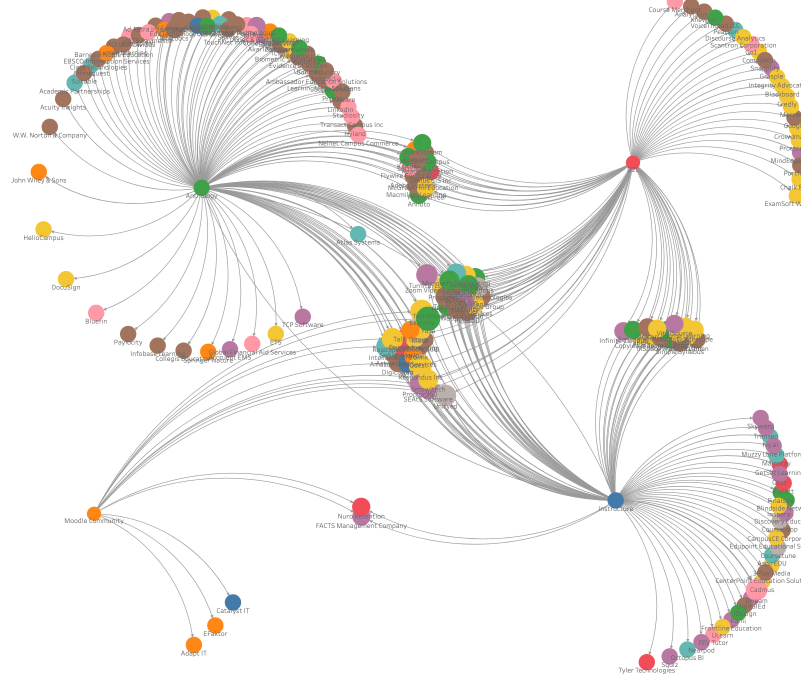

In Figure 2 below, there is a noticeable increase in partner overlap within the LMS product group, yet a significant portion maintains a one-to-one ecosystem model. It is also important to note that Anthology partnerships in Figure 2 also include the ones related to its ERP system. This business dynamic is intriguing as it underscores the interdependence between the core product and its ecosystem. Each entity relies on the other for growth and viability. Larger companies inherently have an advantage in attracting partners, thereby enhancing their prospects for business collaboration. However, the proliferation of partnerships also correlates with increased growth potential for a company. This situation presents a classic chicken-and-egg scenario, where the presence of partners is essential for growth, yet growth facilitates the acquisition of partners. For the LMS product group, companies having partnerships with multiple solutions are mostly in Certification / Assessment, Proctoring, or Web Conferencing / Online Communication solutions.

While a company has the option to acquire one of its partners, such actions could adversely impact or discourage other current or potential partners. Salesforce excels in creating the perfect balance in this regard and knows exactly when to acquire and when to sign partnerships. Maintaining a transparent and well-defined roadmap is crucial to enabling partners to comprehend their role and identify areas where they can contribute while providing clarity on potential eliminations or adjustments.

Summary

This exploratory study shows that edtech business partnerships vary from one product category to another. While all partnerships retain the same objectives (integrating cutting-edge technologies into educational environments, enabling personalized learning experiences, enhancing teaching efficacy, and improving student outcomes), companies adopt a different approach given the group where they evolve. By leveraging the power of collaboration, companies in this space can unlock new opportunities, drive meaningful impact, and, ultimately, shape the future of education for generations to come.